The cryptocurrency industry faced significant crypto losses in January 2025, with hackers stealing nearly $74 million across 19 separate attacks.

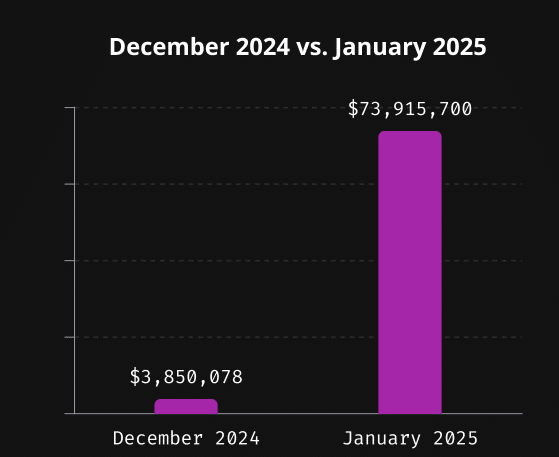

According to the latest Immunefi report, this marks a 44.6% decrease from January 2024’s losses but represents a concerning nine-fold increase from December 2024.

Breaking Down the Major Events of Crypto Losses

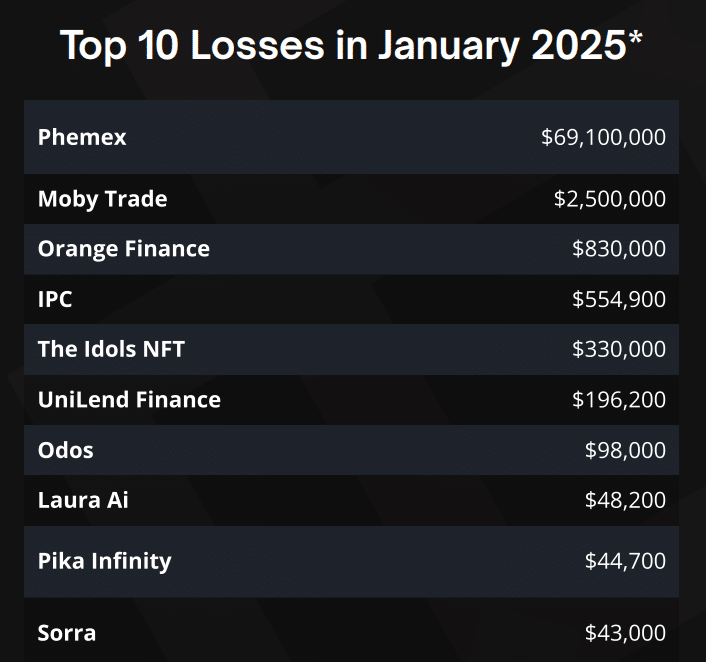

The Singapore-based cryptocurrency exchange Phemex took the hardest hit, losing $69.1 million in a single attack.

This incident alone made up 93.5% of January’s total losses. The second-largest breach targeted Moby Trade, an options trading platform, which lost $2.5 million—though the platform later recovered $1.5 million of the stolen funds.

Understanding the Attack Patterns

January’s security breaches showed clear patterns in how hackers target cryptocurrency platforms.

The BNB Chain emerged as the most vulnerable network, suffering 10 separate attacks that made up half of all incidents. Ethereum followed with six attacks, while newer networks Arbitrum and Base each experienced two breaches, and Optimism recorded one attack.

The data reveals an important shift in attack focus: centralized finance (CeFi) platforms bore the brunt of the damages, accounting for 93% of all losses. Meanwhile, decentralized finance (DeFi) projects experienced more frequent but smaller attacks, with 18 incidents accounting for just 6.5% of total losses.

Other notable victims included:

- Orange Finance, losing $830,000

- IPC, with losses of $554,900

- The Idols NFT project, suffering a $330,000 breach

This month’s security failures highlight ongoing challenges in protecting cryptocurrency platforms. While the overall loss amount decreased compared to the previous year, the sharp increase from December 2024 suggests that crypto hackers continue to find new ways to exploit vulnerabilities.

The concentration of crypto losses in centralized exchanges, particularly the Phemex incident, underscores the risks of keeping large amounts of cryptocurrency on these platforms. This trend might push more users toward decentralized solutions or cold storage options, despite DeFi platforms facing their own security challenges.

The frequency and sophistication of these attacks emphasize the critical need for stronger security measures and better risk management practices across both centralized and decentralized platforms.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.