Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

SUI Price Forecast: March 5

The SUI price forecast suggests that the market structure will likely sustain the ongoing downtrend unless the current upward movement successfully breaks out of the parallel channel.

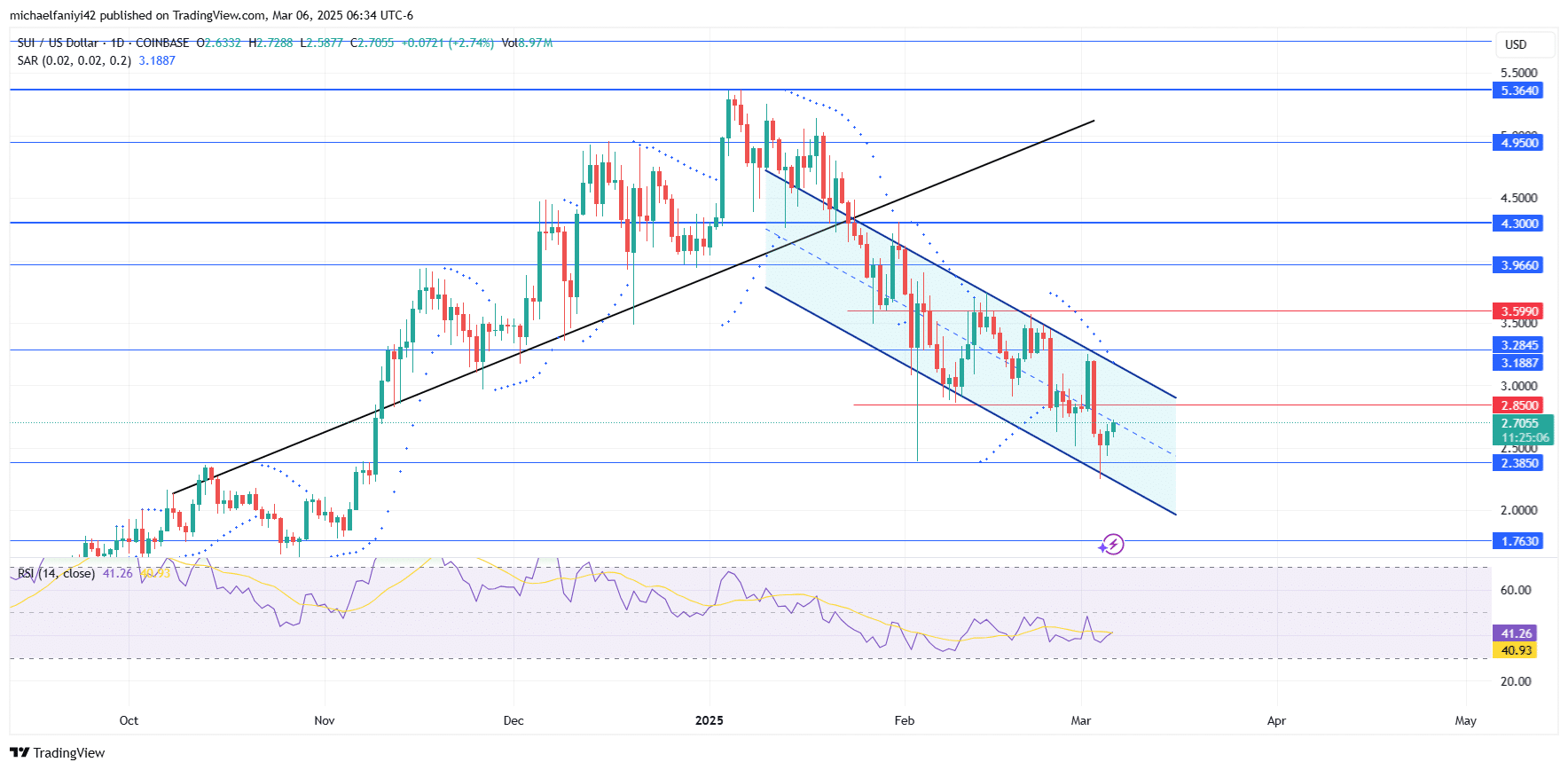

SUI Long-Term Trend: Ranging (1-Day Chart)

Key Levels:

Resistance Levels: $4.3000, $3.5990, $2.8500

Support Levels: $2.3850, $1.7630, $1.0020

SUI Price Forecast: SUI/USD Outlook

SUI/USD has been moving downward within a parallel channel, exhibiting a back-and-forth price pattern.

This movement results in more Parabolic SAR (Stop and Reverse) dots appearing above the daily candles than below them. The coin has now reached a significant demand level at $2.3850.

Although the RSI (Relative Strength Index) line remains in bearish territory, it has yet to reach oversold conditions. Instead, it is trending sideways, indicating market indecision.

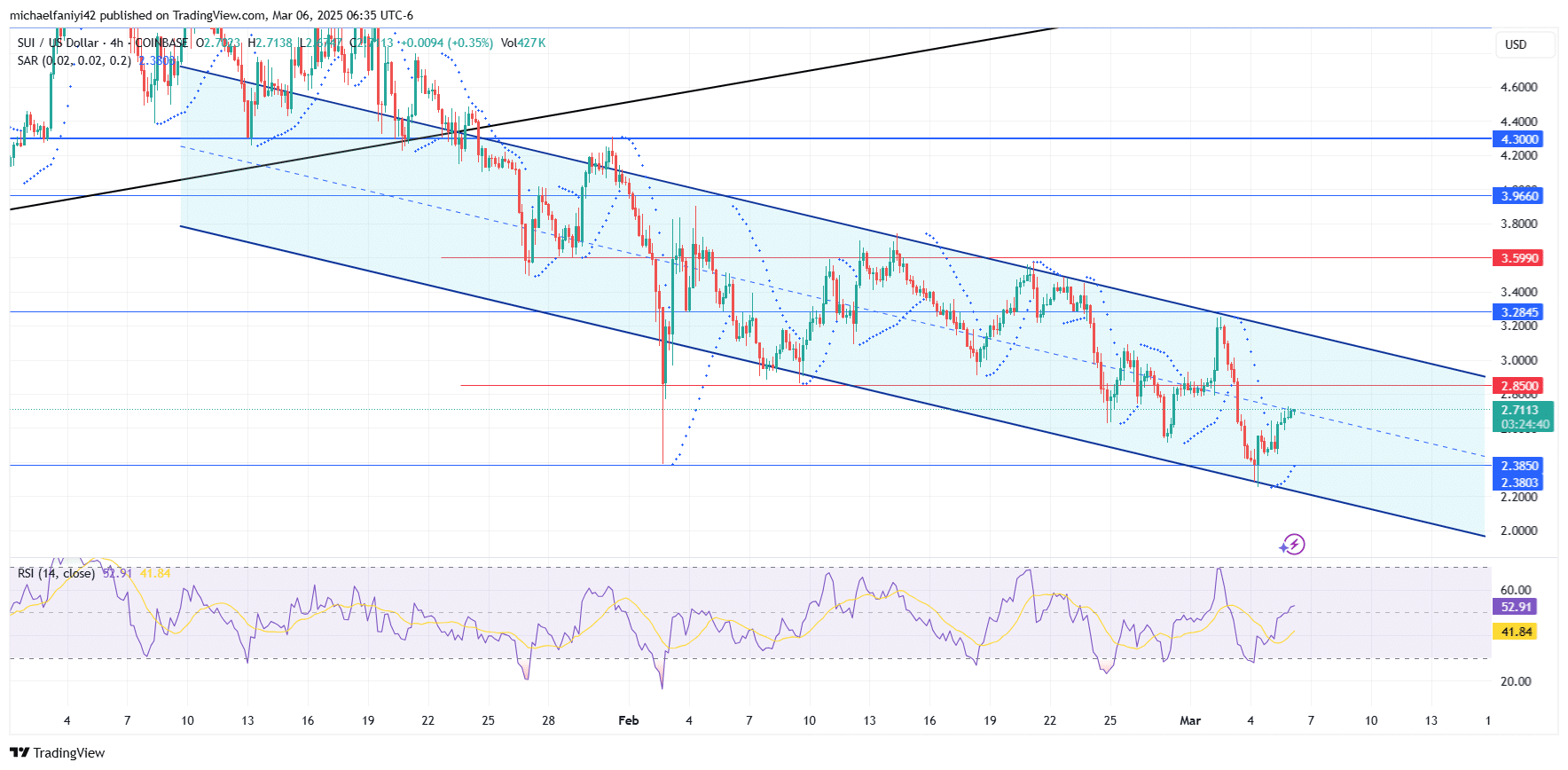

SUI Medium-Term Trend: Bullish (4-Hour Chart)

The back-and-forth movement is even more pronounced on the 4-hour chart. While the Parabolic SAR dots are scattered around the price action, those positioned above the candles outnumber those below, aligning with the daily chart.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.