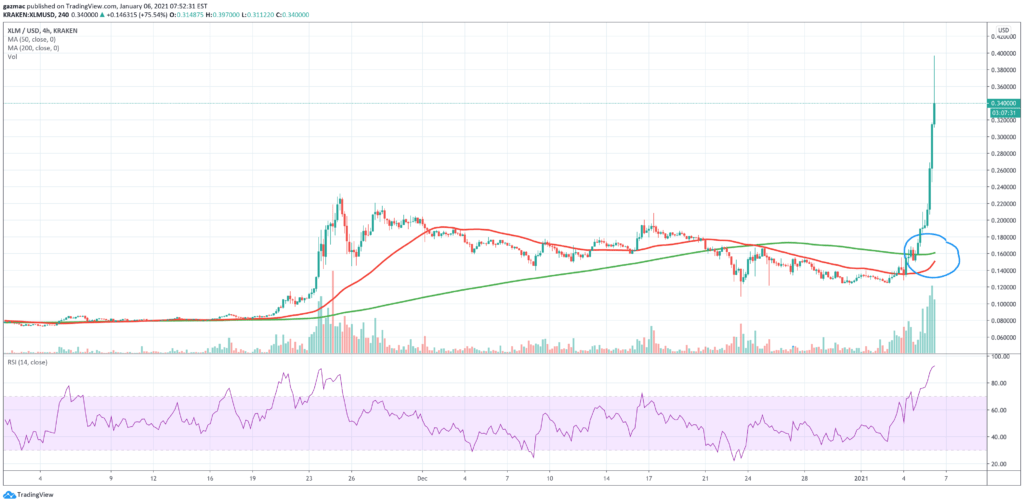

Stellar Lumens (XLM) has more than doubled in value over the past week and on a 1-day view it is up 77%.

The breakout follows news that the Ukrainian government has partnered with the Stellar Development Foundation to build a central bank digital currency (CBDC) for the country.

Currently priced at $0.34, the token is still way off its all-time intra-day high at $0.94 printed on 5 January 2018.

Altcoin season is in full flow as market participants go on the hunt for the next bitcoin. But unlike bitcoin, which is finding a role as digital gold, XLM was designed first and foremost to solve the cost and efficiency problems associated with cross-border financial transactions.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

Its scalability and cheapness to operate as compared to say Ethereum, makes its underlying technology particularly attractive and perhaps explains the interest from Ukraine, although it is unlikely that the country will be using the XLM blockchain, although a permissioned version is certainly a possibility.

The tie-up with Stellar does not stop at developing a CBDC though, as the country also wants to leverage the Stellar team and tech to help it put in place an infrastructure for virtual assets in the country.

What is Stellar and how’s adoption going?

Stellar was founded by Jed McCaleb in 2014 after he left Ripple. As with Ripple, Stellar is designed for cheap and fast cross-border transactions, but unlike Ripple is open source and the Ripple Foundation is a non-profit organisation. Its core product functions in a similar way to RippleNet, using funded gateways and a bridging currency for instant transactions.

Stellar has been racking up some impressive partnerships, in recent years.

For instance, US tech giant IBM is using the Stellar blockchain to build its IBM Blockchain World Wire product. The bridging currency does not use XLM but instead an IBM-Stellar developed stablecoin called Anchor USD, which runs on the Stellar blockchain. Anchor USD is insured by the US Federal Deposit Insurance Corporation.

Other partners include Wirex, fund management firm Franklin Templeton, payment fintech Stripe. Mexico-based Saldo, which is building a remittance network, and TEMPO which is doing the same for the eurozone countries.

There are likely to be more partnerships coming down the pipe, especially after this latest breakthrough at the sovereign level.

Ukraine has one of the highest rates of crypto adoption in the world and a tech savvy workforce. But with CBDCs and stablecoins already a trend that set to become further entrenched as China readies the launch of its digital yuan with two largescale trials already completed, Stellar is well-placed to be a beneficiary.

Also, given the regulatory troubles of Ripple Labs, the issuers of XRP, it looks very much like many of the XRP warriors, if not entirely giving up on Ripple, are certainly providing momentum for XLM’s advance. (It is worth noting that outside of the US XRP is recognised as a currency in a number of jurisdictions, most notably Japan and that may have stopped the bleeding in the XRP price for the moment. Also, hopes of new management at the Securities and Exchange Commission that takes a different view as to whether Ripple issued an unregistered security when it distributed XRP may also help.)

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

Given this week’s huge run-up, a pull-back may be around the corner for XLM, but with the token a long way off its all-time highs, entry even at these levels will probably be rewarding, assuming buyers have the stomach to ride out the near-term volatility. Having said that, waiting for an imminent pullback may be prudent.

The technical view

Although the relative strength index (RSI) is flashing a strong overbought signal, the price appreciation on such strong volumes will reassure bulls entering at even these elevated levels.

The speed of the climb higher means that the 50-day moving average (MA) is still below the 200 MA, as a golden cross looms, providing further encouragement for daring bulls.

The risk profile of altcoins has improved when measured against bitcoin. Put that another way – BTC keeps printing new gigantic highs but the vast majority of alts are yet to do so, although Ethereum looks like the most likely to at least recapture its all-time high.

But with bitcoin set to continue its upward trajectory, helped along by the Democrats’ likely control of all three branches of the US government which some see as adding to the possibility of the return of inflation, it should keep the wind blowing into the sails of the alts, XLM included.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.