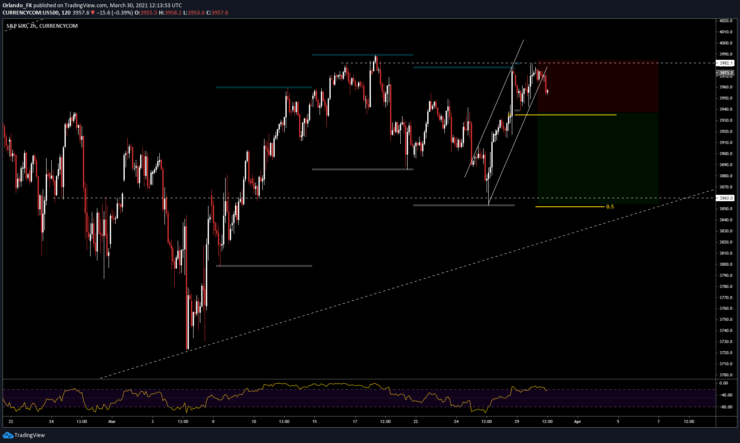

Key Support: 3860

The SP500 has rallied strongly since the last pullback from mid February to the beginning of March (-6.16%). After that 2 week pullback it rallied 7.17% to all time highs to see another pullback to last week´s lows (-3.41%).

It has now retested and is in the process of rejecting the very same level it hit on March 17th, breaking in the process the short term bullish structure and printing a big bearish engulfing candle (4H).

Shorting equities in today´s reality of massive rounds of quantitative easing can be counter intuitive but we´re not trying to position ourselves short here for a awing trade. Sellers are stepping in at these highs and the probability of another leg down is high given the fact that big buyers are not going to step in here, they will wait for price to retest the lows to jump in.

Having said that, we need price to break the previous lows and the weekly pivot to get triggered and we are looking to take profits at the previous week´s lows which is also the 50% retracement of the last impulse.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.