S&P 500 Price Analysis – June 9

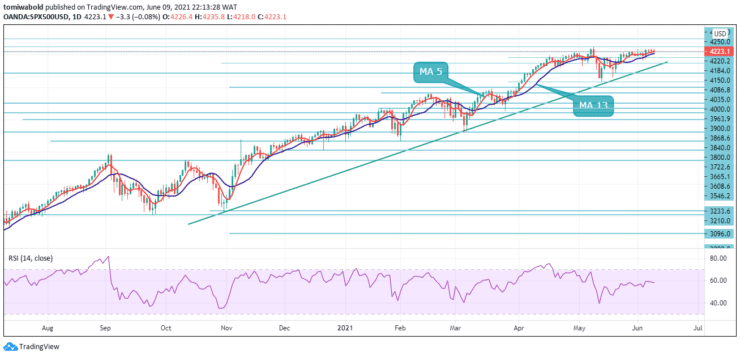

Following the advance beyond the 4200 marks, the S&P 500 has been in its anticipated accumulation phase, with a relatively close trend swinging upwards towards all-time highs. An eventual closing break above 4238 and a continuation of the uptrend are eyed by investors.

Key Levels

Resistance Levels: 4350, 4300, 4250

Support levels: 4184, 4086, 4000

S&P 500 Long term Trend: Ranging

On the daily charts, the S&P 500 has moved into positive sideways trading, and the index may try to break through the next resistance level at 4250. Meanwhile, if the bulls are unable to reclaim control at this point, a retreat towards the next support at 4184 levels is possible.

The longer-term tendency remains cautiously upwards, with first resistance near 4250, which must be overcome to clear the way for a move into 4300 levels. However, we may see a more rigorous evaluation of a cluster of projection levels back in the 4000/4150 region in the near term.

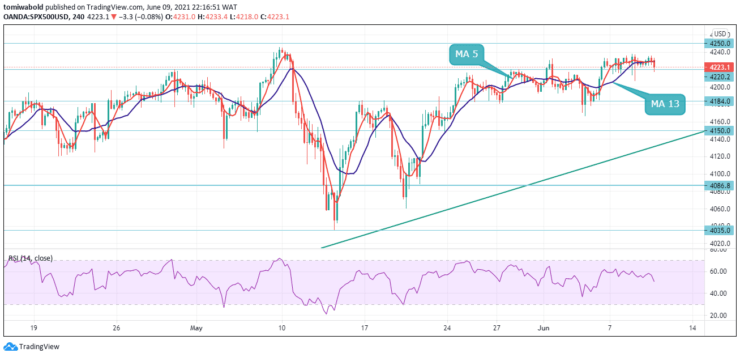

S&P 500 Short term Trend: Ranging

On the 4-hour time frame, the S&P 500 index is in an upside range trend, which suggests intra-day trades can be derived in line with the larger time frame’s trend. The price has established a ranging pattern on the 4-hour time frame, and they usually break in the direction of the present trend.

The RSI is now trading above its midpoints, but the horizontal resistance at 4250 could act as resistance for the index in this session and the next. If the index falls, the horizontal support line at 4184 levels will provide support on dips, allowing buyers to re-emerge.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.