EUR/USD has decreased a little in the short term but the bias remains bullish. The price has retested the weekly pivot point and now it looks ready to trade higher. The DXY is under big pressure right now ahead of the US inflation data released tomorrow.

Today, the German Trade Balance increased from 14.0B to 15.9B, exceeding 15.7B expectations. DXY’s further decline could weaken the greenback which should drop versus all its rivals.

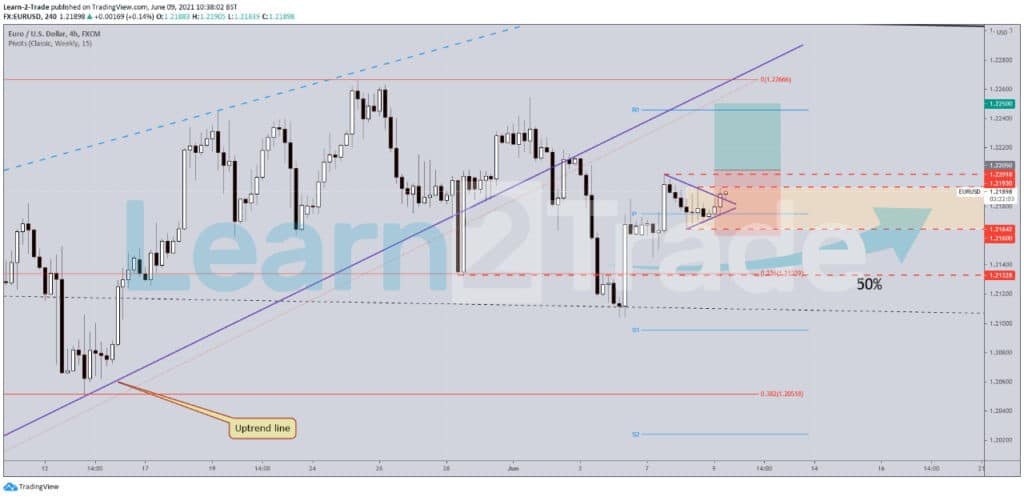

EUR/USD H4 Technical Analysis!

EUR/USD is traded at 1.2191 and is pressuring the 1.2193 former high, static resistance. Closing above it could signal strong buyers in the short term. Also, jumping and stabilizing above the 1.2201 level could really announce strong growth.

Its failure to stabilize under the 23.6% retracement level or to approach and reach the weekly S1 (1.2095) signaled that we may have upside momentum. NFP data invalidated a potential larger correction.

Some poor US inflation data reported tomorrow could boost EUR/USD. The volatility could be high around this high-impact event.

Conclusion!

The pair has decreased only to test and retest the weekly pivot point (1.2174) after its aggressive breakout. A new higher high could activate a potential growth towards the R1.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.