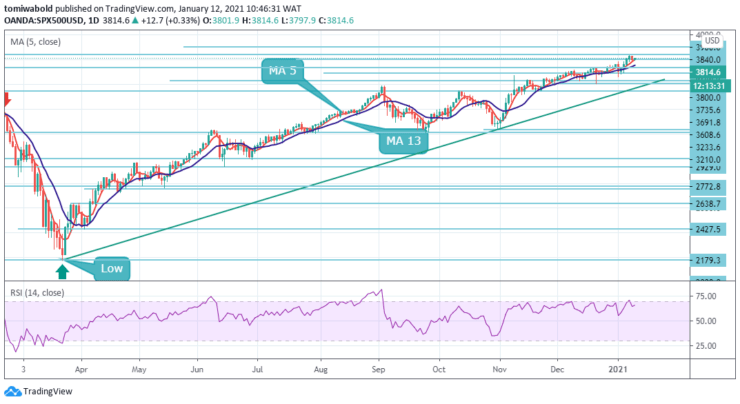

S&P 500 Price Analysis – January 12

S&P 500 alternates around 3801-3816 levels, up 0.19% intraday during early Tuesday, and fails to extend the prior day’s pullback from a recent high of 3831.4 level. The uncertainty over US President Donald Trump’s reign joins the coronavirus (COVID-19) woes to weigh on risks.

Key levels

Resistance Levels: 4000, 3900, 3840

Support Levels: 3735, 3691, 3546

On the daily charts, S&P 500 has gone ahead moving positively into sideways trading and the index may attempt the next resistance level at 3840. Meanwhile, if the bulls cannot take back the reins at this juncture, then there is scope for a retracement towards the next support at the 3735 levels.

The longer-term bias stays cautiously higher with further resistance seen at 3900 initially, above which is required to clear the path for a further advance towards 4000 levels. In due course though we may see a tougher test of a cluster of projection levels in the 3850/85 band.

The S&P 500 index is in an upside ranging trend on the 4 hour time frame and this means that intra-day trades may be derived in line with the bigger time frame’s trend. Looking at the 4-hour time frame, the price has formed a ranging pattern and they usually break in the direction of the current trend.

As for the RSI, it is trading beyond its midlines, however, the horizontal resistance at 3840 could provide resistance for the currency index within this session and the next. On the other hand, if the S&P 500 returns lower, it is supported on dips by the horizontal support line at 3735 levels where buyers may re-emerge.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.