S&P 500 Price Analysis – January 5

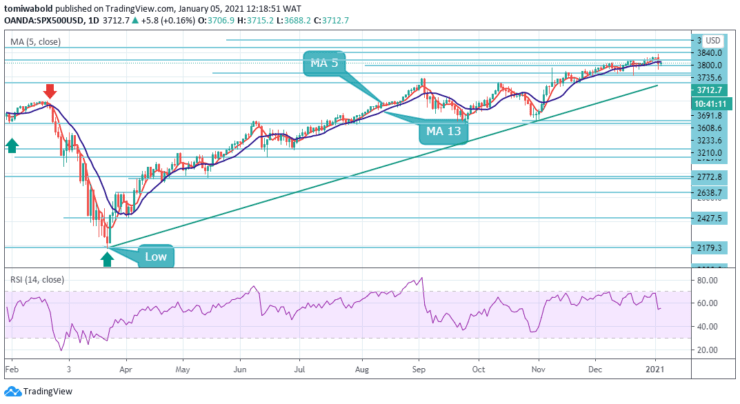

S&P 500 opened near 3706 levels, and it’s up at almost 0.50% intraday, during the European session on Tuesday. The index has recovered upside traction after the prior day’s low of 3663.4 level. The latest rally suggests the latest vaccine optimism may be among the market movers.

Key Levels

Resistance Levels: 3840, 3800, 3735

Support Levels: 3691, 3629, 3546

The S&P 500 is set to recover its recent high at 3784.2 level, which is a key high to watch out for from a technical perspective. A significant break above the 3735 horizontal resistance medium-term level could push it to open the door for a further advance past the recent significant high at 3784.2.

On the other hand, momentum indicators may soon indicate the continuation of the initial technical pullback from the overbought zones. The immediate support levels on the daily charts can be found at 3629, followed by 3595.6 and then 3550 thereafter.

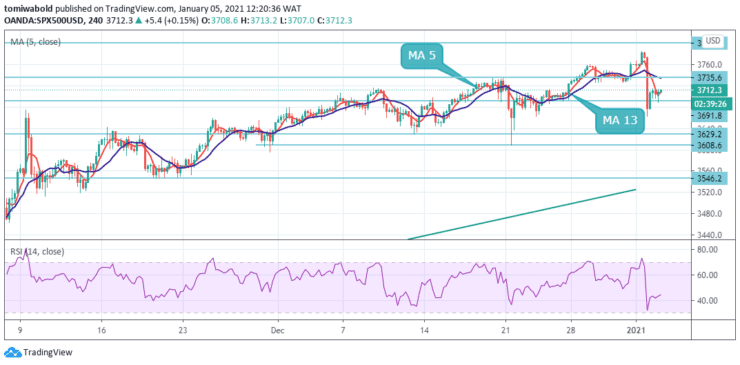

The S&P 500 surged by 10 pips or 0.50% during the early Tuesday trading session. The index is trading within the moving average 5 at the upside channel pattern beyond the 3691.8 near term support levels. Technical indicators demonstrate that the index is likely to range during the following trading session. The potential target for bulls would be at the 3800 levels.

However, the horizontal resistance at 3735 could provide resistance for the index within this session and the next. On the other hand, if the S&P 500 returns lower, it is supported on dips by the horizontal support at the 3629.2 levels where buyers may re-emerge.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.