The Nasdaq 100 (NDX) saw a damning 3% decline from a fresh all-time high around 12950 before recovering just halfway (1.5%) by the close of the market yesterday. This decline is the tech-heavy index’s worst daily performance since December 9. Meanwhile, the S&P 500 (SPX) also closed yesterday’s session at -1.5%, while the Dow Jones (DJIA) closed at -1.3%. Both the Dow and S&P 500 recorded new all-time highs at the open of the market yesterday before erasing all gains.

Monday’s crash came amid growing worries of the increasing number of Covid cases across the globe and its potential effect on the global economic recovery.

In the UK, Prime Minister Boris Johnson reimposed a national lockdown in England to help combat the spread of the new variant of the Coronavirus. According to data from Johns Hopkins University, more than 85 million Coronavirus cases have been confirmed globally, with the US being the worst-hit with 20.7 million cases and 2.7 million in the UK.

In other news, Wall Street traders were also keeping an eye on Georgia, as the state is set to organize its Senate runoff elections today. Many speculators have trumpeted the possibility of the Democrats winning both seats. However, some speculators fear the possibility of that happening, with Jason Pride, the CIO of Private Wealth at Glenmede noting that “if the GOP wins just one seat, they will likely stonewall some of Biden’s more ambitious proposals, but a Democratic sweep of both elections might give the incoming administration free rein on their policy agenda.”

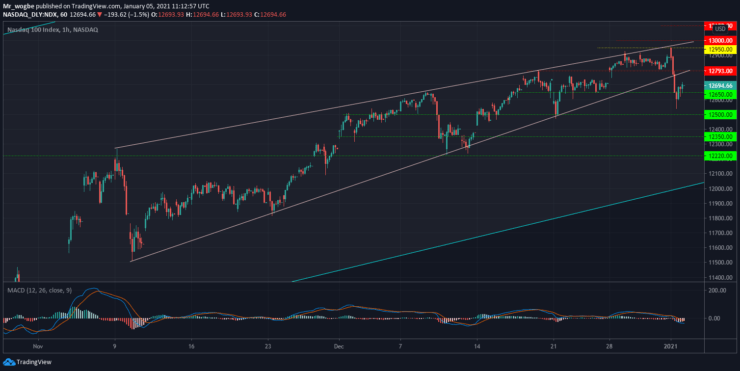

Nasdaq 100 (NDX) Value Forecast — January 5

NDX Major Bias: Bullish

Supply Levels: 12793, 12860, and 12900.

Demand Levels: 12650, 12600, and 12550.

The NDX recorded a steep correction over the past 24 hours that sent it to the 12500 area, just after it recorded a fresh ATH at 12950. The index has recovered modestly from the decline but is still about 2% away from the recent ATH. that said, we expect the NAS100 to recover fully and resume its ascent towards the 13000 psychological resistance in the coming days and weeks.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.