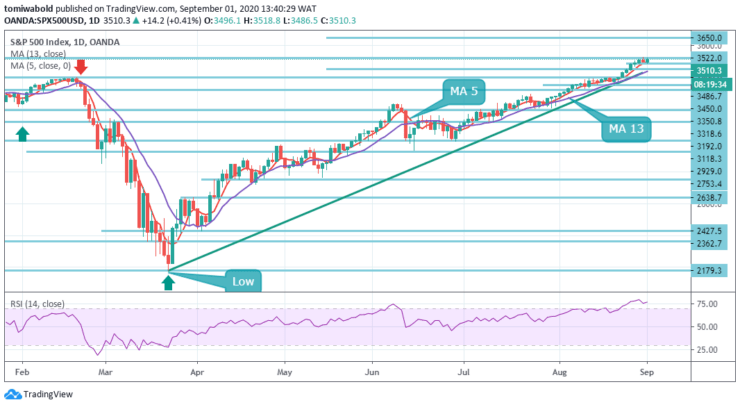

S&P 500 Price Analysis – September 1

The S&P 500 showed a very good breakout beyond the peak and all-time high previously. The uptrend is ready for continuation simultaneously. From the low of March 23, the S&P 500 has continued to rise a whopping 55 percent – the biggest pullback in the record. With no sign of retreat, the upside breakout stays unabated.

Key Levels

Resistance Levels: 3750, 3650, 3522

Support Levels: 3450, 3350, 3192

The S&P 500 daily chart is showing a clear uptrend and any deeper retracement remains potential support towards the horizontal lines beneath price at 3450 levels. The current push up seems a critical breakout that occurred when price action crossed known barriers.

The uptrend may be expected to continue in case the market rises above resistance level 3522, which will be followed by reaching resistance level 3650. A downtrend will start as soon, as the market drops below support level 3400, which will be followed by moving down to support level 3192.

As observed in the 4-hour time frame, the S&P 500 has retraced from the key resistance at 3522 levels easing down 0.01% at 3507 levels. Meanwhile, it has gone ahead to trade past the 3500 levels today. But in any case, near term outlook will remain bullish as long as the 3400 support level holds.

Buyers may target long positions beyond 3522 levels with eyes at 3650 & 3750 levels in extension. In the alternative scenario, sellers may target beneath 3400 levels to look for further downside with 3350 levels as targets.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.