However, the SPX has rounded off August with its best performance since April. The index grew by more than 7%, snapping multiple all-time highs along the way.

Meanwhile, Apple Inc (NASDAQ: APPL) and Tesla (NASDAQ: TSLA) led the way with gains after the companies’ stock split went into effect yesterday. Tesla gained more than 12% as investors continue to jostle for the electric vehicle manufacturers’ shares.

Market participants will be looking at the ISM data, set for release later today, for clues to how the US economy performed in August. Also, the Labor Department will be reporting the highly-coveted non-farm payroll report on Friday.

Meanwhile, Fed Vice Chair, Clarida, went on record to say that the Federal Reserve will not raise interest rates simply because the unemployment rate was dropping. Despite the heavy bullishness seen in the NDX and SPX, the VIX volatility index etched back above the 25% level, which is indicative of some nervousness in the market and a potential reversal in September.

Nasdaq 100 (NDX) Value Forecast — September 1

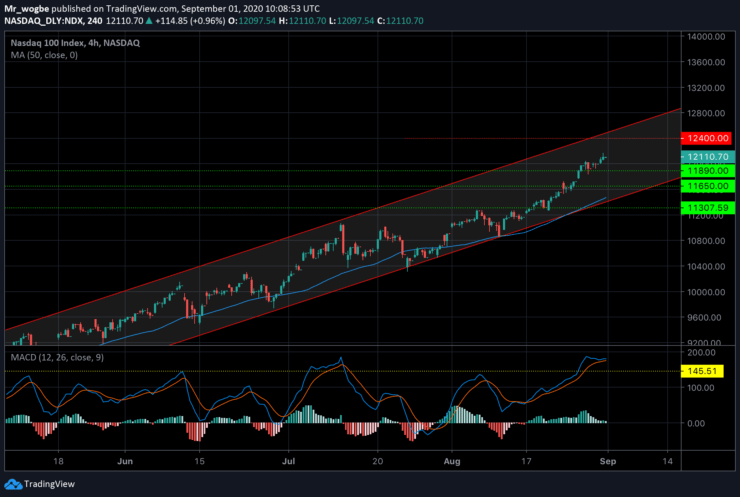

NDX Major Bias: Bullish

Supply Levels: 12190, 12270, and 11735.

Demand Levels: 12000, 11890, and 11650.

Nasdaq 100 remains in a strong bullish trend in our ascending channel. We appear to be approaching key resistance at 12400. Failure to clear that resistance could send us back to the 11890 supply level in the near-term.

Meanwhile, based on our MACD indicator, we’re currently in overbought conditions and a slight retrace might be underway.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.