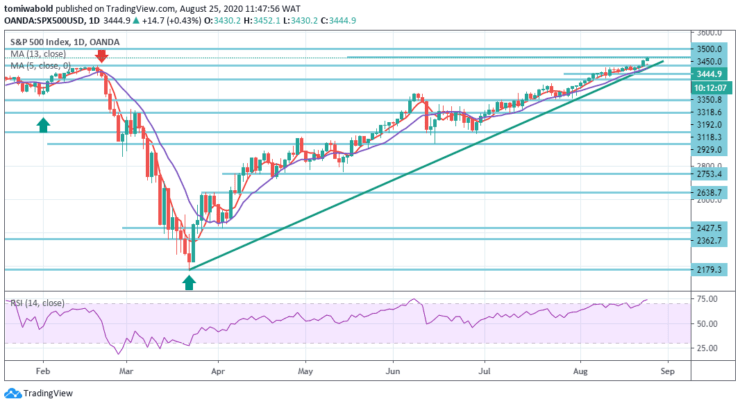

S&P 500 Price Analysis – August 25

S&P 500 Futures is on the bids near the 3445 level during the European session on Tuesday. The risk barometer recently registered 4 consecutive positive sessions at a fresh all-time high of 3452 levels while extending the biggest run-up of 2020 weekly.

Key Levels

Resistance Levels: 3700, 3600, 3500

Support Levels: 3400, 3318, 3192

The S&P 500 has rallied a bit during the trading session on Tuesday after it cleared the 3400 levels during the prior session. At this point, the market is likely to go looking towards the 3500 levels, a large, round, psychologically significant figure that investors are expecting.

Either way, the S&P 500 enjoyed a technical milestone as it confidentially established price action above resistance offered by prior highs around 3400 level. Technically, the focus now is whether the S&P 500 will pick up upside momentum after clearing the 3450 levels.

As observed on the 4-hour time frame, the S&P 500 finally took out 3400 key resistance with conviction and closed up the prior day 1.00% at 3431.28 record high. Meanwhile, it has gone ahead to breach the 3450 levels today. But in any case, near term outlook will remain bullish as long as 3350 support level holds.

Next, near term target will be 61.8% projection of 2179.3 to 3192 levels from 2929 at 3350 levels. Buyers may target long positions beyond 3400 levels with eyes at 3450 & 3500 levels in extension. In the alternative scenario, sellers may target beneath 3400 levels to look for further downside with 3350 levels as targets.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.