The Nasdaq 100 (NDX) gained 0.61% after rising by 71.01 points to close around 11626.17. The Nasdaq Composite (^IXIC) also gained about 0.6% yesterday and made a record high. The Dow Jones (DJIA) grew by 1.35% and the S&P 500 (SPX) wasn’t far off with a gain of +1%.

Also, AstraZeneca (NASDAQ: AZN) share price was boosted to about 2% on the back of the news that US regulators were considering speeding-up the drug manufacturer’s Coronavirus vaccine. The drugmaker has denied having any private discussions with the Trump administration before this development.

Meanwhile, on Friday, Apple Inc (NASDAQ: APPL) provided a huge boost to the Nasdaq 100 and the S&P 500 (which the indexes might still be reeling from) after its share price closed above $500 just a few days after it became the first public US company to reach a $2 trillion market value. Apple stock gained 1.2% yesterday.

Moving on, market participants will be looking forward to Fed Chair Jerome Powell’s comments in Kansas City Fed Jackson Hole Symposium set to hold later in the week in a virtual format.

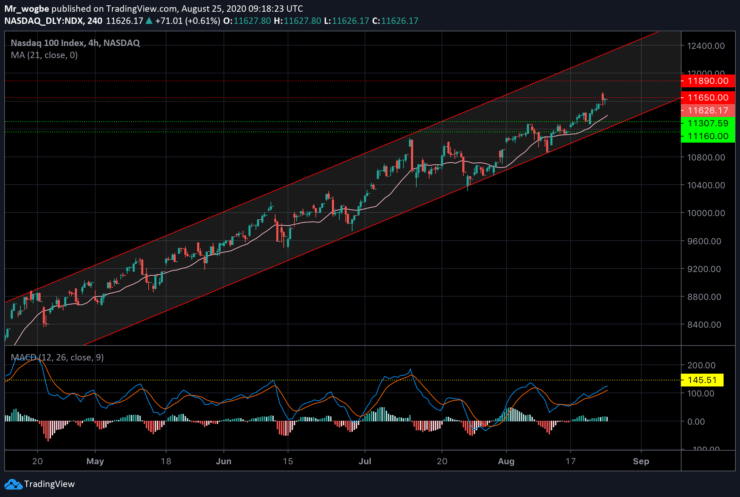

Nasdaq 100 (NDX) Value Forecast — August 25

NDX Major Bias: Bullish

Supply Levels: 11650, 11890, and 12000.

Demand Levels: 11400, 11307, and 11160.

The index remains strongly within our 4-month ascending channel and appears to likely remain so in the coming months. Yesterday’s rally saw the NDX print a new all-time high around 11728 after a decent bull-run. However, a slight retrace was seen as the restrictive attributes of 11650 resistance came into play.

If the NDX fails to take the resistance in the near-term, we could see a further correction to the 11400 resistance (21 SMA), which could facilitate a strong bounce for the index.

The next target for the Nasdaq 100 is the 11890.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.