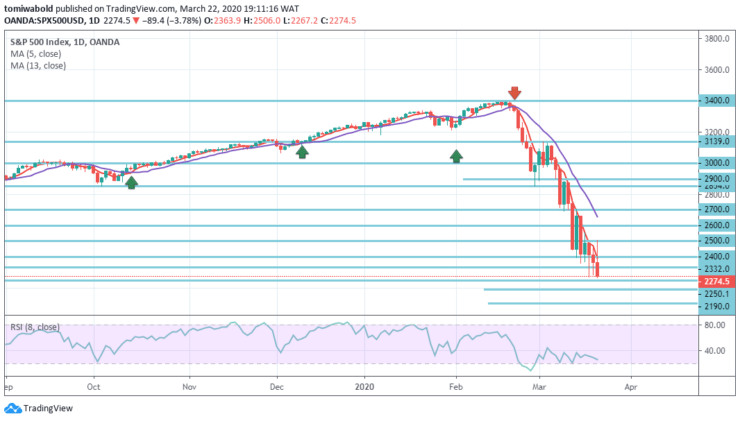

S&P 500 Price Analysis – March 22

After a few days of consolidation, the market looks to restart to the downside. The S&P500 is now in a selling market as it has fallen from its recent rise to 2500 by more than 20 percent while investor sentiment is weakening. Given major monetary and fiscal stimulus, last week stocks around the world continued to end sharply lower.

Key Levels

Resistance Levels: 3000, 2600, 2332

Support levels: 2250, 2100, 2000

S&P 500 Long term Trend: Bearish

In the last few weeks, the S&P 500 has given up about a third of its value. After a few days of consolidation, the market revert to the downside. The S&P500 is currently on a bear market as it fell from the recent high by more than 20 percent and now trading at 37-month lows.

The drop below the level of 2250 may, in the long run, cause further declines towards the price levels of 2100 and 2000. Price levels of 2400, 2500, and 2600 are likely to serve as resistance going forward.

S&P 500 Short term Trend: Bearish

Technically, the zone at 2500-2600 is a level for the S&P 500 seen as an overshoot on the 4-hour time frame— a level the S&P 500 has already traded below. Hence more reductions in gross exposure by investors could push the liquidity-driven overshoot lower than anticipated.

For investors with a 6-12-month horizon, the 2550-2600 level range may offer an attractive risk-reward buying opportunity on the upside perhaps the market retraces, but the bearish trend remains intact as sentiments worsen.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.