GBPUSD Price Analysis – March 22

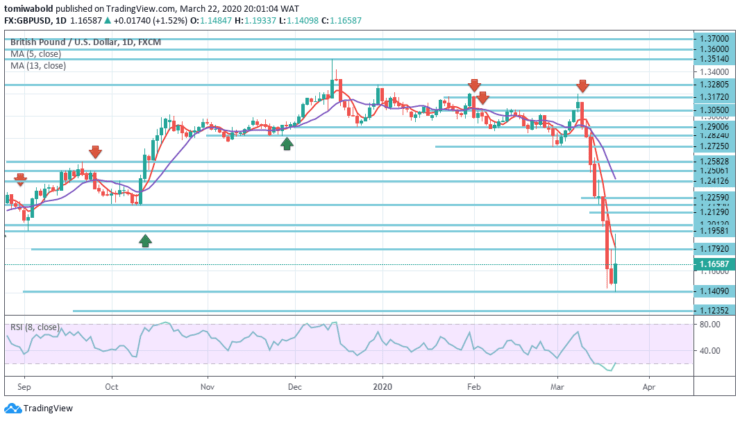

The GBPUSD pair exited in the green on Friday but had come from a fresh multi-decade low of 1.1409 level. The pair plunged for a second consecutive week, as the response to the coronavirus outbreak from the UK government came too late. The greenback stays high on the market while the pound stays under pressure, influenced by risk aversion, on the contrary.

Key Levels

Resistance Levels: 1.3280, 1.2582, 1.2129

Support Levels: 1.1409, 1.1235, 1.0273

GBPUSD Long term Trend: Bearish

The GBPUSD pair has settled past the 1.1600 levels but far beneath the high level of its Friday at 1.1933 level while on the daily chart it displays that technical indicators have recovered modestly from severe levels but still in oversold territory, quite well beneath the moving averages, keeping the danger skewed to the downside.

The downward trend from the level 1.3514 (high) has persisted in the larger structure. The next long-term goal would be a forecast of 61.8 percent from 1.3514 to 1.0273 to 1.3280 to 1.1792 levels where in either case, in case of a strong recovery, the trend may stay bearish as long as 1.3514 resistance level holds.

GBPUSD Short term Trend: Bearish

The pair have struggled to recover above a bearish moving average of 5 in the 4-hour chart, currently at 1.1800 level, although technical indicators stay within negative ranges, the momentum is advancing but the RSI is going down to 40.

Last week’s fall in GBPUSD accelerated to a level of 1.1409, then developed a temporary low there and recovered. For consolidations first, the initial bias stays neutral this week. But a 1.2129 minor level of resistance may contain recovery to bring about a resumption of the fall.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.