S&P 500 Price Analysis – June 23

Amid the massive US fiscal and monetary stimulus, the bullish sentiment around the S&P 500 Index stays active past the level of 3100. The risk yardstick broadens the gains of the prior day as US policymakers look forward to furthering efforts to accelerate the markets.

Key Levels

Resistance Levels: 3300, 3250, 3216

Support levels: 3078.4, 3000, 2900

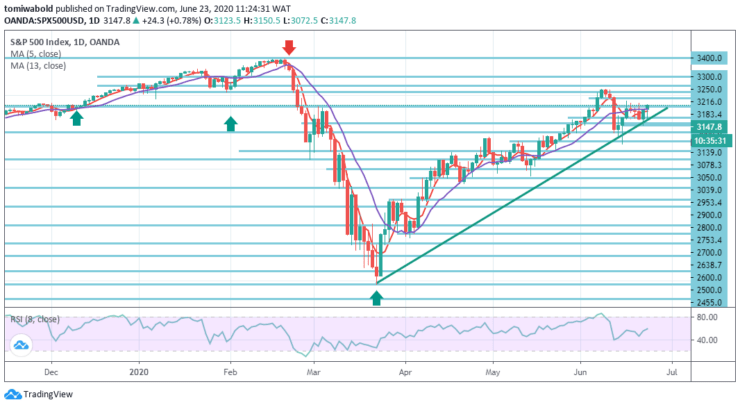

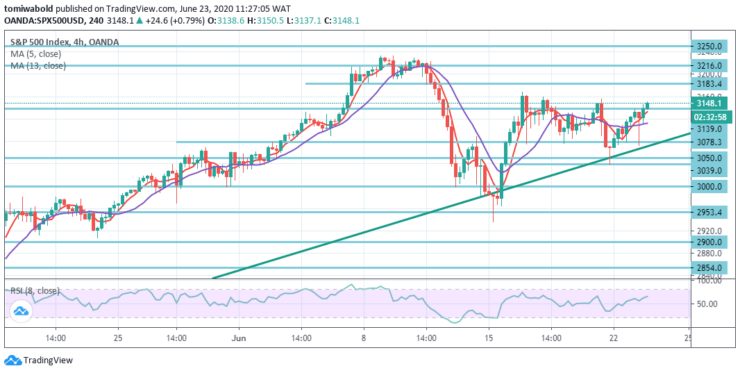

Aside from a brief collapse, the S&P 500 retests the top of the broken bullish barrier around 3183 levels after holding past the 5 and 13 moving averages and key support at level 3050. The bulls are heading to see the index reclaim the broken trend while the bears are trying to see the index slip back beneath key level 3000.

From a simple perspective, it would be very bullish if the S&P ended today’s session well beyond the level of horizontal resistance at 3183 after the key downside reversal from the level at 3072 on the day. The level 3183 is now the Bulls’ first line of defense.

On the alternative hand, a successful attempt now reached beyond the moving averages of 5 and 13 may send traders searching for gains up to the level of 3183 at 23.6 percent. Once the index maintains its positive momentum, the next resistance maybe around the 3216 level-3250 line.

On the downside, should prices move down, initial support may emerge from the upward level’s 38.2 percent retracement of 2953 to 3216 at 3078 levels before hitting the 3050 levels. A breach of this level may potentially open the way to the near-term support level at 3039 ahead of the 3000 psychological mark, which is the retracement of 50.0 percent.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.