White House Adviser Peter Navarro’s dovish statements on the Sino-American trade deal yesterday, set the market into a risk-off mood. This sentiment was further boosted by the latest Covid-19 numbers from China as well as troubling news concerning the dragon nation.

The US policymakers placed Chinese media on the list that mandates the outlets to follow guidelines like foreign embassies. This action has further escalated the US-China tensions at a period when the Trump administration has been quiet on the trade deal. The reason might be as a result of China’s ban on meat from America’s Tyson.

The increasing number of Covid-19 cases in China coupled with a grim outlook from the World Bank President David R. Malpass has added a burden on the market’s risk sentiment.

On a brighter note, news suggesting that an increased supply of a possible cure to the virus by the end of the year and the US Democrats $1.5 trillion infrastructure plan may well restrict a full-blown risk aversion wave in the market.

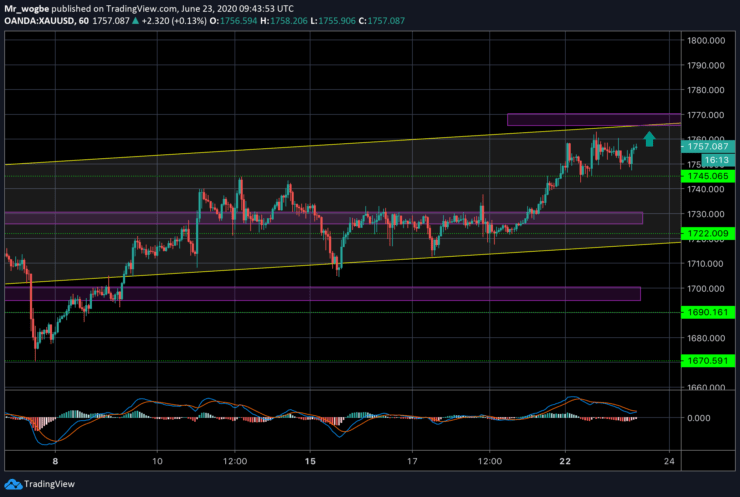

Gold (XAU) Value Forecast — June 23

XAU/USD Major Bias: Bullish

Supply Levels: $1,765, $1,770, and $1,775

Demand Levels: $1,750, $1,745, and $1,735

Unless we see a—not so likely—fall below the $1,722 mark, gold will remain strongly bullish for the time being. A sustained break above the $1,765 is the much-awaited catalyst for a drastic increase in price. The $1,800 round figure continues to look more and achievable by the day.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.