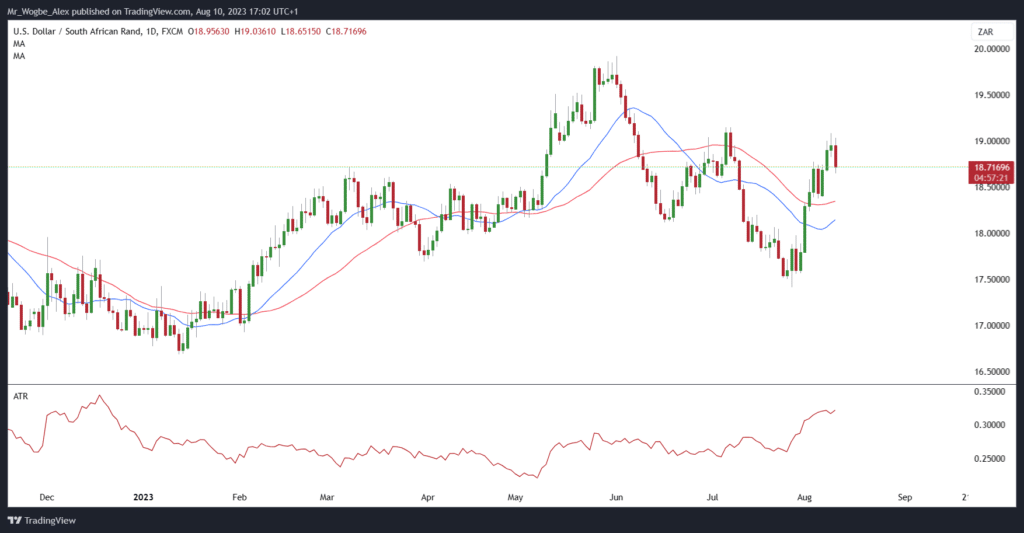

In a dynamic display of strength, the South African rand surged against the dollar on Thursday, capitalizing on a weakened dollar that stemmed from the release of U.S. inflation data for July. As of the time of writing, the rand confidently held its ground at 18.71 against the dollar, marking an impressive ascent of 1.25% from its previous closing rate.

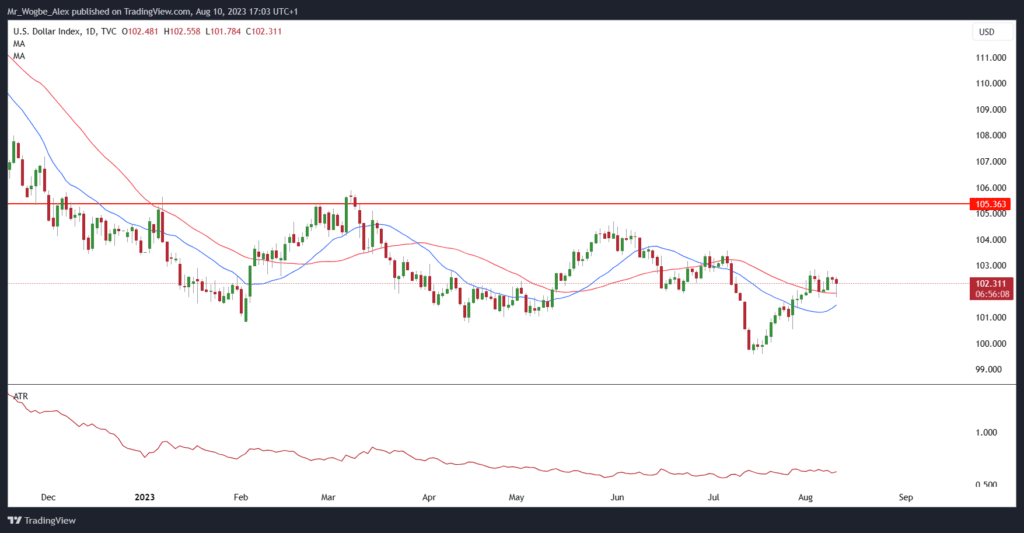

Simultaneously, the dollar, once a dominant force, displayed a 0.30% weakening against a broad spectrum of global currencies, as shown by the dollar index (DXY). This favorable exchange rate situation has provided an opportune moment for the rand to assert its strength.

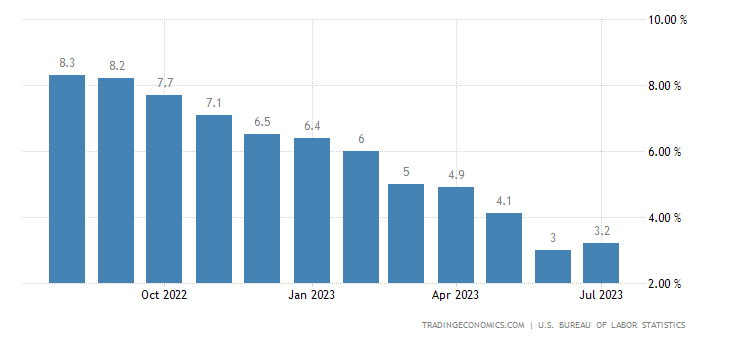

The keen eyes of market participants were fixed on the U.S. Consumer Price Index (CPI) data, a pivotal metric that gauges inflation trends. The latest report revealed a modest uptick to 3.2% in July from the preceding 3% in June. In the wake of this data, Danny Greeff, co-head of Africa at ETM Analytics, weighed in on the rand’s reaction, indicating that the data alone did not present a compelling case for the rand to weaken further at this juncture, according to a Reuters report.

The prevailing sentiment within the financial markets leans towards a scenario in which the Federal Reserve concludes its interest rate hikes for the year, guided by the current moderation in inflation. Yet, Greeff sagely acknowledges the fluid nature of market dynamics, allowing for shifts in this outlook.

South African Rand Remains Very Volatile

The South African rand, known for its characteristic oscillations, has once again demonstrated its propensity for volatility. This pattern, described by analysts from Rand Merchant Bank, underscores the currency’s intriguing ebb and flow, where it can undergo weeks of underperformance followed by periods of impressive gains.

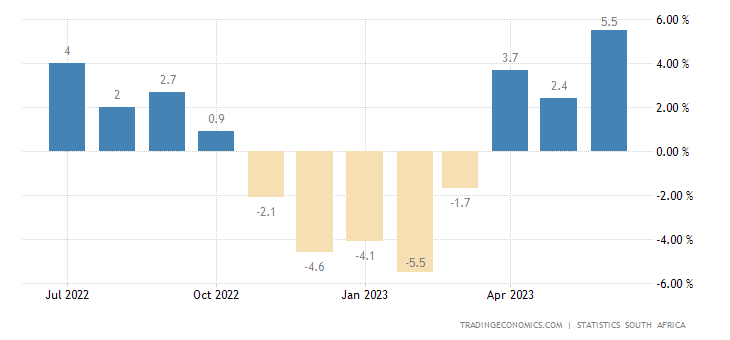

Shifting our focus to the domestic economic landscape in South Africa, a brighter narrative emerges. Recent data reveals a heartening trajectory in manufacturing output. For the month of June, the sector showcased resilience by surpassing expectations, registering impressive year-on-year growth of 5.5%. Additionally, the mining sector chimed in with its own positive contribution, defying forecasts of contraction to achieve year-on-year growth of 1.1% in June.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.