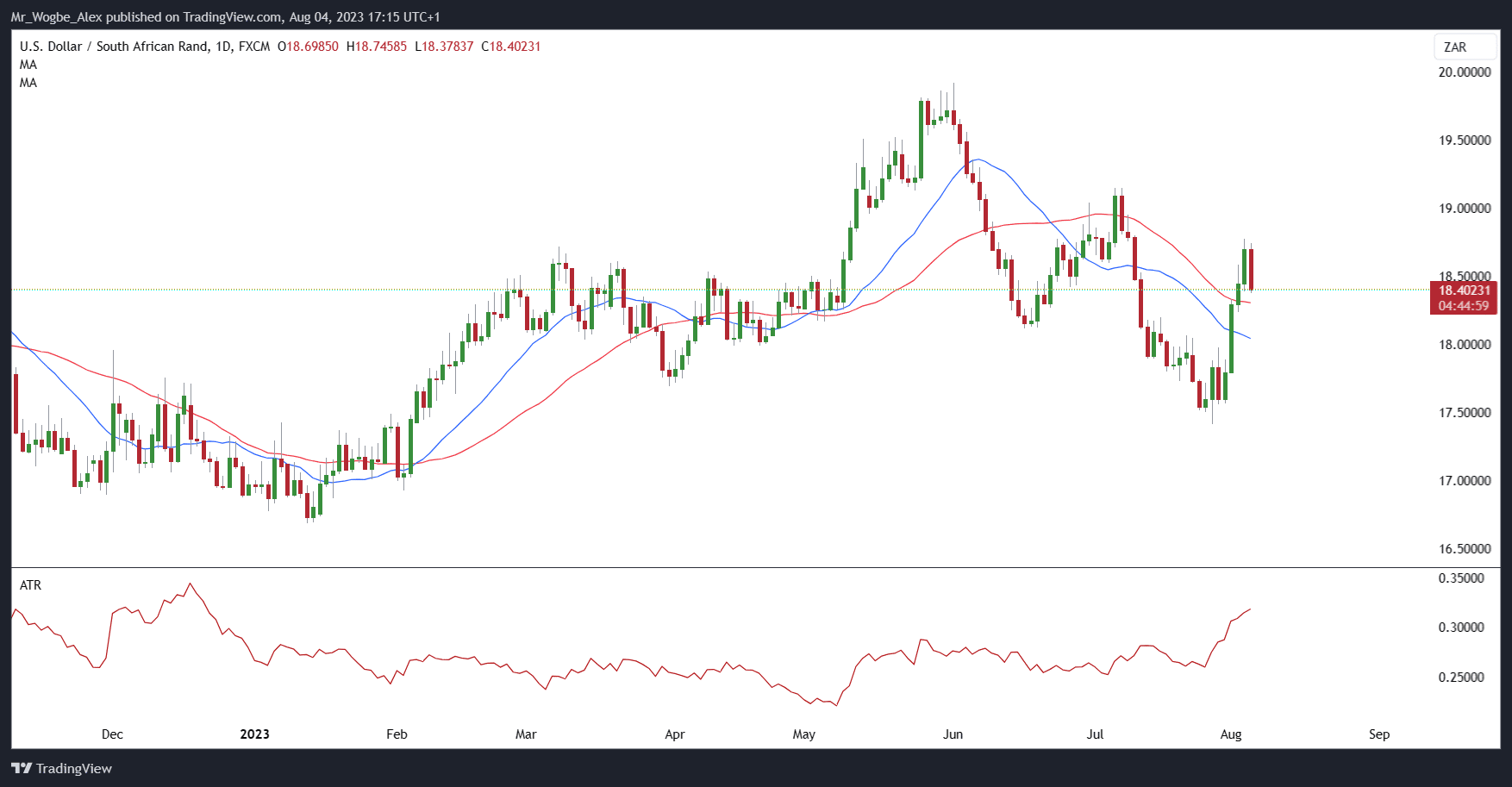

In a compelling turn of events, the South African rand showcased remarkable resilience against the US dollar during Friday’s trading session. The currency’s resurgence was notably propelled by a decline in the greenback’s value, which was spurred by a batch of encouraging employment data.

As of the time of this report, the rand boldly stood at 18.40 against the dollar, marking an impressive gain of over 1.5% from its previous close.

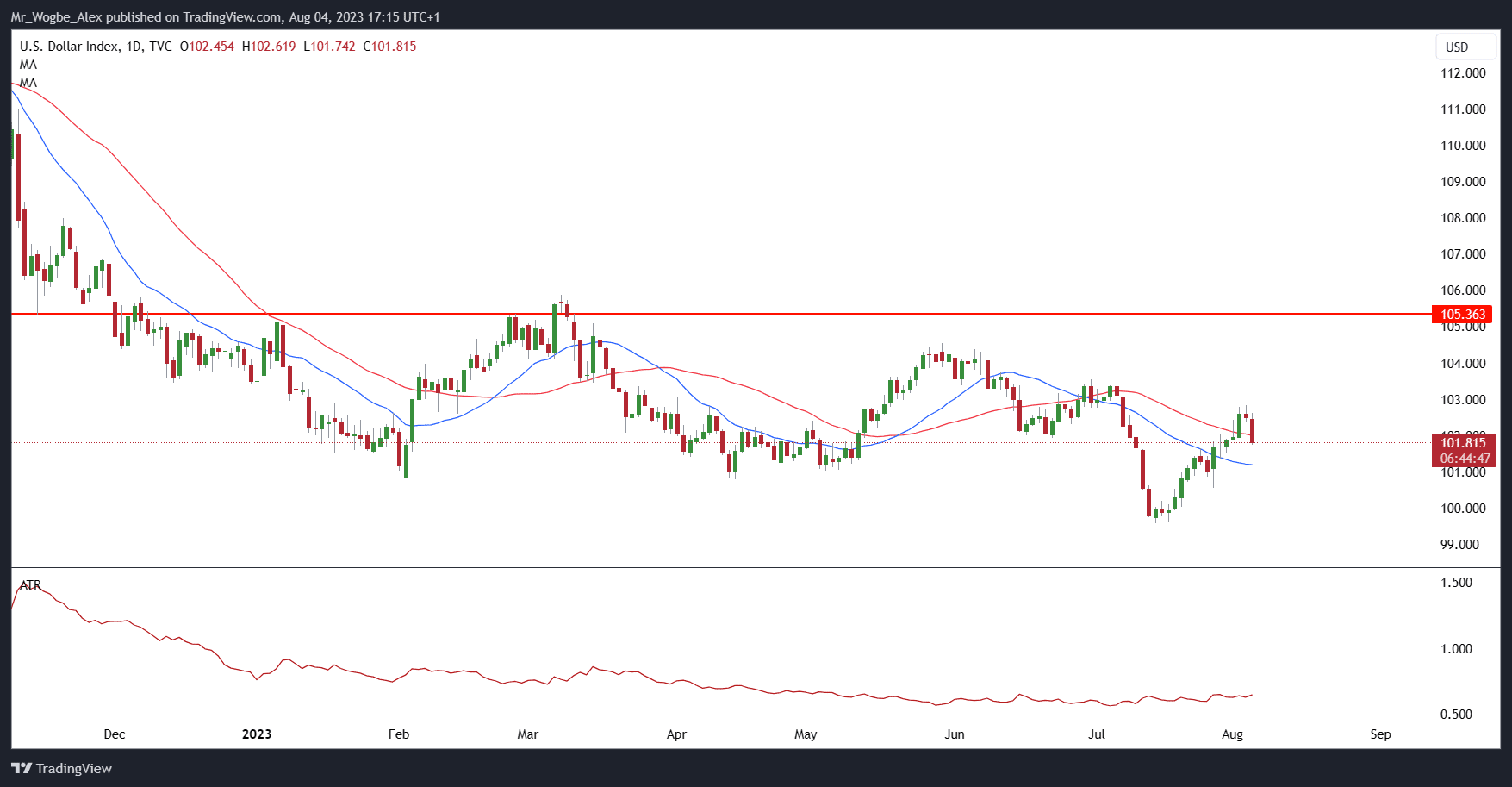

In a parallel narrative, the US dollar displayed a measured retreat of approximately 0.6% against a diverse basket of global currencies, ultimately settling at 101.815.

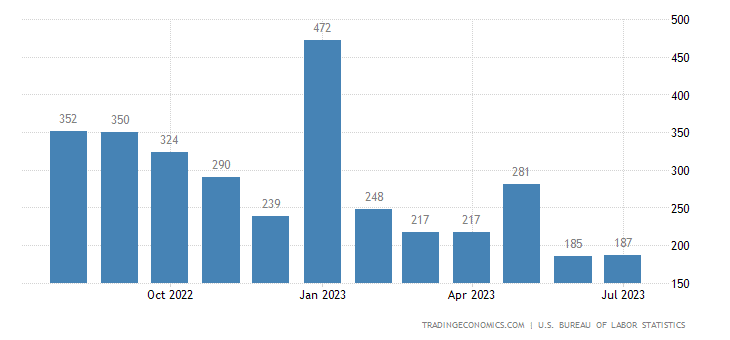

This recalibration of currency dynamics could be primarily attributed to the release of nonfarm employment data from the United States.

The data revealed moderate growth in the colossal American economy throughout the month of July. The consequential weakening of the dollar’s value triggered a cascading effect across the currency market, amplifying the rand’s newfound strength.

Rand Falls by 5% On the Larger Scale

However, amidst this encouraging resurgence, the South African rand had navigated a challenging trajectory earlier in the week, witnessing a massive 5% depreciation against the steadfast US dollar. This notable decline was primarily fueled by escalating concerns surrounding global economic growth, which were further compounded by an undeniable escalation in risk-off sentiment.

According to Reuters, this week’s somber currency performance was exacerbated by the credit rating agency Fitch’s consequential decision to downgrade the United States’ credit rating from AAA to AA+. This move, occurring earlier in the week, effectively stirred the waters of risk-averse sentiment, exerting palpable pressure on the currencies of emerging markets.

As the week’s curtains draw to a close, the South African rand traverses the intricate terrain of global currency markets, determinedly striving to recapture and bolster its momentum amidst the ever-evolving tapestry of economic forces.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.