The Chicago Mercantile Exchange (CME), a prominent global platform for derivatives trading, has experienced a remarkable upswing in crypto options trading during the month of July, a development highlighted by data sourced from CCData. These crypto options, a dynamic financial instrument offering investors the ability to buy or sell a crypto asset at a predetermined price in the future, have garnered substantial attention in recent times.

Crypto Options Volume Rises to $941 Million

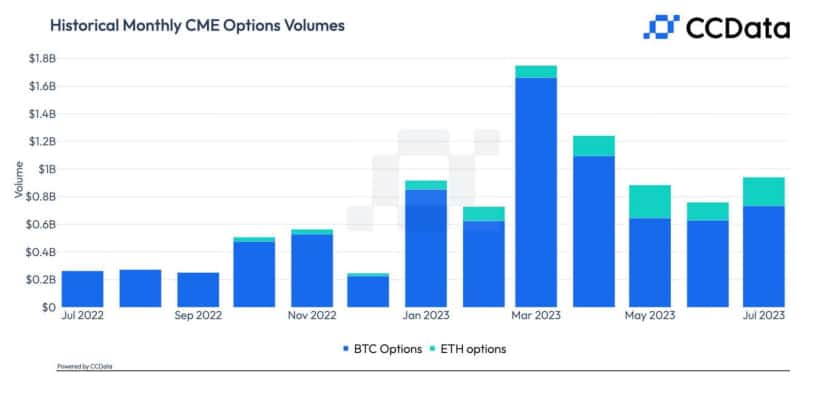

The month of July witnessed an impressive 24% surge in the aggregate trading volume of crypto options on the CME platform, an achievement that propelled the total volume to an impressive $941 million. This resurgence in activity marks a noteworthy rebound, representing the first monthly growth spurt in the last four months.

Meanwhile, the surge in trading volume was underpinned by both Bitcoin and Ether options, which exhibited a commendable increase of 16.6% and an astonishing 60%, respectively. This resulted in Bitcoin options contributing a substantial $734 million to the trading volume, while Ether options further enriched the tally with a significant $207 million.

The rationale behind this remarkable increase in trading activity, as outlined by CCData, is the heightened demand for hedging tools. The prevailing market uncertainty and the accompanying spikes in volatility have led investors to seek effective risk management strategies, with crypto options presenting themselves as a prudent solution.

In July, the crypto market experienced a modest decline, with Bitcoin and Ether prices retracting by 4.12% and 4.02%, respectively. This pullback was influenced by concerns surrounding regulatory shifts and vulnerabilities exposed by DeFi hacks.

Apart from that, Bitcoin showcased an intriguing correlation with traditional assets like stocks and gold. This demonstrated a closer correlation with the market than observed in the previous month, thereby highlighting its evolving role within the broader financial landscape, as highlighted by CoinDesk.

Crypto Futures Volume Dips in Tandem with Global Economic Slowdown

While the trading volume of crypto futures on CME saw a slight contraction of 17.6%, settling at $39.1 billion in July, the decline aligned with a global economic deceleration. It’s important to note that CME offers an array of crypto options based on cash-settled standard contracts, along with micro Bitcoin and Ether futures contracts.

In a broader context, CCData’s report reveals that the cumulative trading volume of both crypto spot and derivatives on centralized exchanges observed a 12% dip, amounting to a total of $2.36 trillion in July. This data marks the second-lowest combined volume since December 2020, with only December 2022 displaying weaker performance.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.