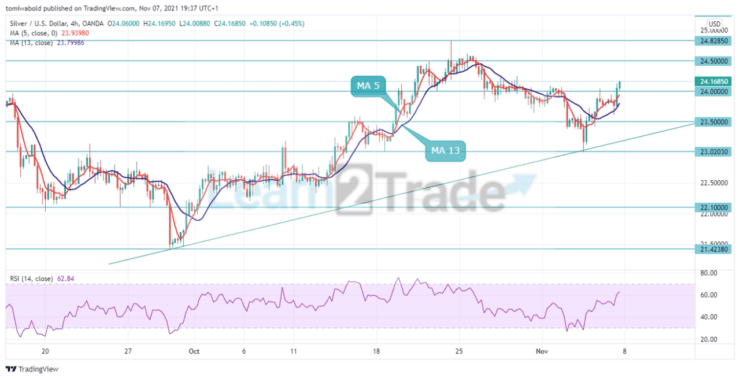

Silver (XAG) Price Analysis – November 7

The price of spot Silver (XAG) has risen significantly in recent trade having breached the $24.00 handle for now. The precious metal buyers look to conquer further barriers and pave the way for an upward move towards the $24.50 level. A continued decline in global and US yields would be required for such a move higher.

Key Levels

Resistance Levels: $25.50, $25.00, $24.50

Support Levels: $23.50, $23.00, $22.10

Silver (XAG) has demonstrated a positive breakthrough beyond the $24.00 resistance level on the daily chart from a technical standpoint. The nearest resistance is likely to be at $24.50, while the first and second support levels are expected to be at $23.50 and $23.02, respectively.

Since the end of October, silver has been climbing in a rising pattern versus the US dollar. Meanwhile, throughout the next session, the rate may find support from the rising trendline support around the $23.50 range. As a result, the price of silver may continue to rise in the present and next session.

On the 4-hour time frame, bulls are currently supporting an optimistic relative strength index trend to hit $24.50 in a second attempt to surpass upward. However, the commodity’s future gain may be hampered by the barrier zones around $24.82 and $25.00.

During the metal’s decline, the $23.50 level is the important support to consider ahead of the psychological horizontal support level near $23.00. If the price falls below $23.00, the $22.10 support level may come into focus, as a negative breach of the level might encourage the bears.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.