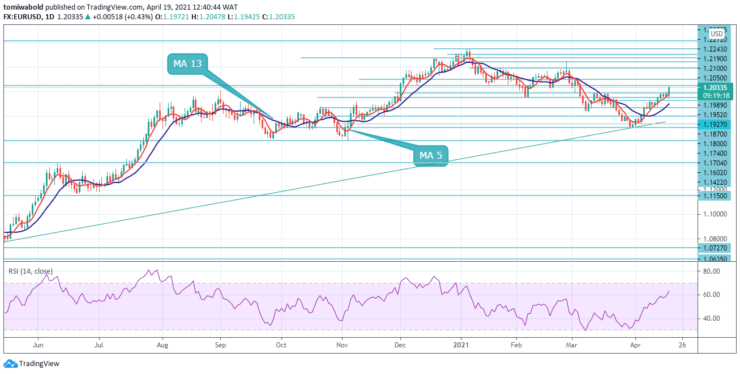

EURUSD Price Analysis – April 19

The early analysis points to a growing chance that EURUSD bursts above 1.2050 level in the new week. After the pair surged through the psychological 1.20 barrier and hit the highest since Mar 4 on Monday. Today’s action is underpinned by dropping bond yields, making the greenback less attractive. Returns on ten-year Treasuries are below 1.56% at the time of writing.

Key Levels

Resistance Levels: 1.2243, 1.2190, 1.2100

Support Levels: 1.942, 1.1870, 1.1740

Over the crucial 1.20 mark, the next levels to watch are 1.2050, 1.2065, and 1.2115 levels, which are all in March and February. The daily low of 1.1942 provides support, followed by 1.1927 and 1.1870 levels, which have accompanied the pair during its recent climb. Meanwhile, the EURUSD advance is easing on approach resistance at 1.2050 level.

In the event of an abrupt pullback, the price is likely to stall near the 1.1989 immediate level of support for the time being. A close below this mark, however, could bring the April 13 lows of 1.1876 into play. If the current bullish trend persists, the EURUSD can lead to break out above the 1.2100 level to confirm further gains.

The 4-hour chart reveals that EURUSD is trading ahead of the moderately bullish 5 moving average which is ahead of the moving average 13 upwards. The RSI has turned north towards the overbought region. A current bullish trend could target a 61.8 percent projection from 1.1704 to 1.2011 levels from 1.1602 to 1.2100 levels in the subsequent sessions.

On the 4-hour chart, the price recovery from the 1.1704 low shows the direction of least resistance to the upside. So far, a decisive break over the 1.2050 marks appears to be in the cards for this session. The currency pair is currently trading around the 1.2034 marks, having reached a peak of 1.2047 in the London session.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.