XAGUSD Price Analysis – June 15

Silver shorts reported a loss of 2.0 percent early through Monday’s European session after a recent rally to mid-$18.00. XAGUSD is trading at a level of $17.23, with its price down from Friday’s close against the USD. Resurgent fears about the third wave of coronavirus infection are anticipated to push demand for metals in the US and China. This may cause a spike in long stakes on the shiny metal in weeks to come.

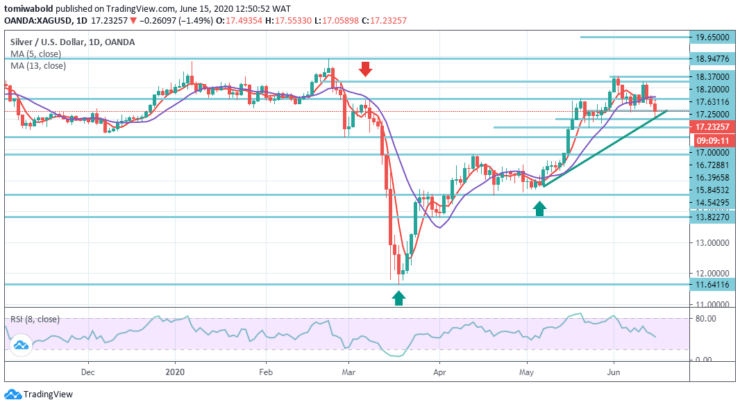

Key levels

Resistance Levels: $18.20, $17.63, $17.25

Support Levels: $17.00, $16.72, $16.39

Daily, Silver oscillations present the significant highs/lows and trade in another position correlating by swing direction although not in trajectory as a whole. Since the end of March, the shiny metal has been in a steady bull trend, after a big false break of $14.00 level.

Its medium to long-term bias is bullish, but if that position reverses, the rate may hold at $17.00 (resistance turned support) level and it is likely to shift back up to $18.20. Bulls may aim into medium-term support for potential buying chances on poor pullbacks.

On the flip side, the pair is intended to find support at $17.00 level, and a rebound from here may propel it to the next $17.25 level of resistance. The pair is intended to find its key level of resistance at $17.63, and a spike through might take it to the next level of resistance at $18.20.

Overall, since the end of March Silver has appreciated against the US Dollar. The exchange rate of XAGUSD runs beyond the level of $17.00. Some upside potential may probably tend to emerge in the market, as the exchange rate at $17.00 level is supported by ascending trendline support. The price for silver, in this case, may increase to $18.00 level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.