Gold’s drop appeared to be unaffected by the recent sell-off in the equity markets which doesn’t bode well for its safe-haven status.

Fears over a second wave of the Coronavirus outbreak and the likelihood of the renewal of lockdowns across the globe threaten the prospect of a sharp V-shaped economic recovery. This comes on the heels of the Fed’s dovish outlook for the US economy alongside poor economic data from China which has weighed heavily on investors’ sentiment.

The risk-off bias was bolstered by a fresh leg down in the US Treasury bond yields. The combination of all these components caused bulls to take flight from the yellow metal. Even the beaten-down US dollar price action failed to bolster the dollar-denominated commodity.

Eyes will be watching to see if gold will be able to attract any dip-buying or will continue on a ‘downhill’ journey keeping in mind that there is little market-moving data release for the week.

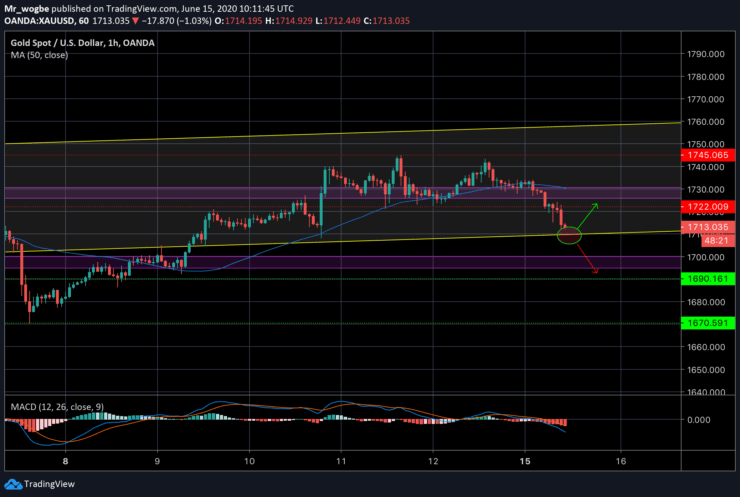

Gold (XAU) Value Forecast — June 15

XAU/USD Major Bias: Bearish

Supply Levels: $1,722, $1,730, and $1,745

Demand Levels: $1,710, $1,700, and $1,690

Following another strong rejection from the $1,745 key resistance, gold has picked up a mild bearish momentum. Gold is currently at $1,713, just a few points away from $1,710 (the baseline of our ascending channel). We should expect to see a strong rejection from that level which could send gold to higher supply levels ($1,722-30). However, failure to bounce from this line could send the price further below the $1,700 pivot in the near-term which could lead to a retest of our key support at $1,670.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.