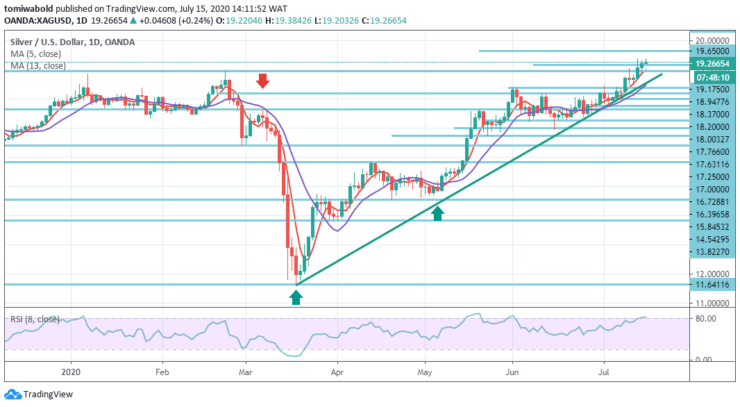

XAGUSD Price Analysis – July 15

The average Silver price was $16.65 level through June’s end. Having dropped dramatically in mid-March, the silver price continued to rally upside, growing by 56 percent to hit $17.84 at the end of June; it has since breached through hurdles towards mid-$19.00 level.

Key Levels

Resistance Levels: $21.00, $20.50, $19.65

Support Levels: $18.37, $18.00, $17.63

Long-term and mid-term bias is bullish and if the broken $19.17 resistance level successfully holds as support a move towards $19.65 level is likely. A break and close back below $19.17 level on the other hand would put $18.94 level back into focus.

Below $18.94 level we’ll look for further downside with $18.00 & $17.76 levels as targets. From a theoretical point of view, a breakout south could likely occur within the following trading sessions. In this case, the XAGUSD exchange rate could gain support from 50.00% and the monthly support at $17.25 level.

On the 4-hour time frame, after a clear false break of $18.94 level, bulls stepped back in and pushed the precious metal higher impulsively, clearing a short-term resistance level at $19.17 in the process.

Price is now beyond the broken short-term resistance and may test the $18.94 level as potential support. Thus, the silver price could continue to go upwards.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.