GBPJPY Price Analysis – July 15

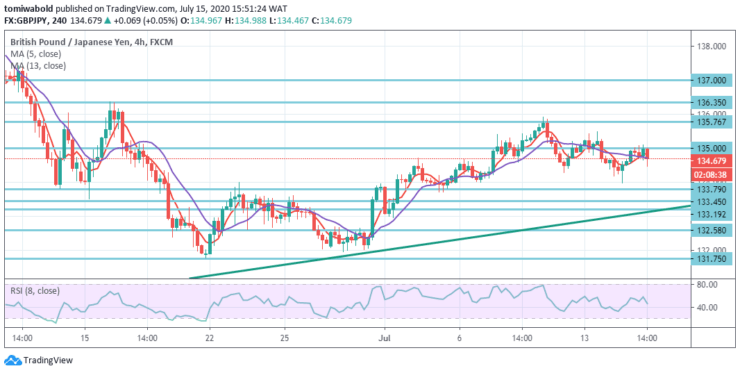

The GBPJPY cross held on to its modest gains through the early European session into American session, albeit has retreated around 20 pips from 135.08 daily high level. On the other hand, the sterling benefitted from Wednesday’s hotter-than-expected UK consumer inflation figures boosting GBP demand.

Key Levels

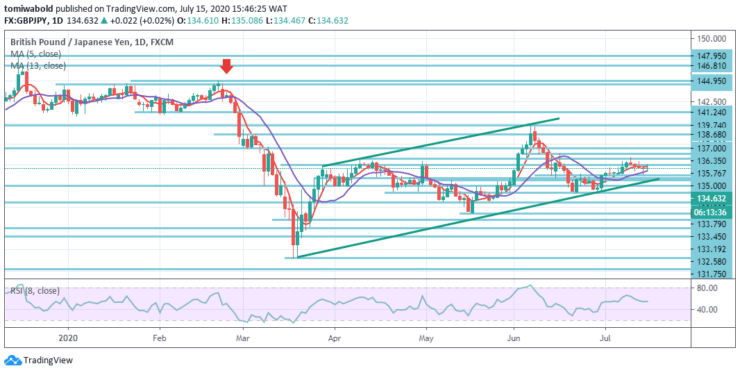

Resistance Levels: 147.95, 139.74, 136.35

Support Levels: 133.79, 131.75,129.29

The GBPJPY developed from sub-134.00 level, or one-week lows, on the strong intraday bounce of the day before and obtained some follow-through traction on Wednesday. One of the main factors driving the GBPJPY cross higher has been seen as a heavy bid tone surrounding the British pound.

In the wider context, we see market behavior from a level of 122.75 (low) as a trend of consolidation horizontally. So long so resistance level 147.95 holds, there is a potential downside breakout in favor. A firm break of 147.95 would however lift the risk of a bullish long-term reversal.

GBPJPY Short term Trend: Ranging

GBPJPY recovers before a lower support level of 133.79 and intraday bias stay neutral initially. As long as there is a lower level of support of 133.79, more increase is slightly in favor. On the upside beyond level 135.76 may expand the recovery from level 131.75 to high level 139.74.

A breach of level 133.76, however, may indicate that the turnaround is over. Instead, the intraday bias is pulled back to the downside for a support level of 131.75.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.