XAGUSD Price Analysis – July 22

Following the dramatic rebound seen since the start of the week, during European trading, Silver (XAUUSD) bulls are pricing in prospects for further uptrend. Its technical setup supports buyers to pump XAGUSD beyond $22.50 level. The appetite for a store of wealth strengthens silver which is supported in part by a rebound in global economic activity.

Key Levels

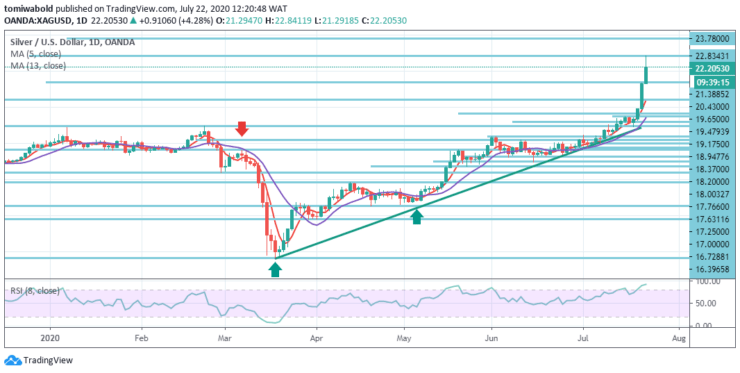

Resistance Levels: $25.00, $23.78, $22.83

Support Levels: $21.38, $20.43, $19.65

Looking at the silver chart we see that the present price is about twice what the record high was. The record-high was around $50 level. Which implies silver has far more space to go higher. The bulls may continue to gain support for as long as it retains at $20.38 level beyond the moving average of 5.

Silver has seen a dramatic spike higher over the past week and has now breached the main high level with ease at $19.65. This indicates that we are now setting a multi-year bottom as anticipated, with the next main test at $22.84 levels.

Next, a look at the peak of the 4-hour chart indicates the breaking of the upward trend line for the week. Any drop to the level of $19.65 may discover buyers at the low. Regarding the latest consolidation, the ongoing spike has established a bull pennant formation, which is typically a bullish continuation trend.

Floating in the lower band of the overbought zone, the short-term Relative Strength Index ( RSI) signals there’s some room for more appreciation. At $21.38 level, the horizontal support line may restrict downside attempts.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.