The yellow metal effectively capitalized on its recent bullish momentum and continued on its gaining spree for the fourth consecutive trading session. The strong move to its 9-year high point was supported by worries that the second wave of the virus infections in the US could stall the economic recovery.

This comes at a time when the US economy has entered a stalemate over the next round of economic stimulus, which has forced the US dollar bulls into a defensive position and has further boosted the appeal for the dollar-denominated commodity. The Democrats and Republicans have been tussling for a while now over a $3 trillion relief bill.

Regardless, hopes for a more fiscal stimulus continued to underpin demand for the non-yielding commodity.

Meanwhile, the recent risk-on mood in the equities market following the latest optimism over a potential Covid-19 vaccine, caused gold bulls to take a pause amid fresh overbought conditions in the near-term.

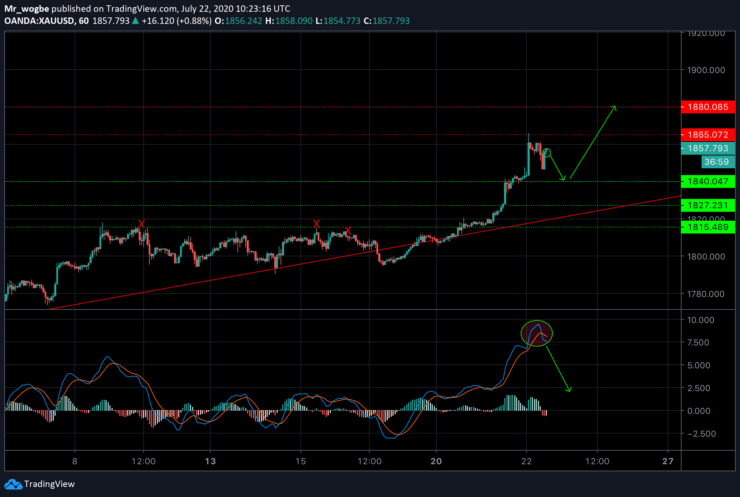

Gold (XAU) Value Forecast — July 22

XAU/USD Major Bias: Bullish

Supply Levels: $1,855, $1,863, and $1,880

Demand Levels: $1,840, $1,827, and $1,818

Gold has outperformed our projections in yesterday’s session as it effortlessly snapped several resistance levels to record a 9-year high of $1,865. This surge was largely due to several fundamental factors as pointed out above.

Meanwhile, we are now in an ‘open playground’ and further upside appears more attainable at this point. The path upwards is currently the ‘path of least resistance, ’ which means we are likely to print fresh multi-year highs in the near-term.

However, gold is now fully in overbought territory and a modest dip from this level is imminent. The yellow metal is likely going to be met with strong dip-buying at $1,840 (if it gets to that level), which could send it higher in the near-term.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.