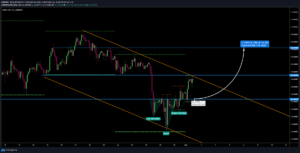

Having said that, it was too late on Friday’s session to enter but today we saw Silver dip at Sunday’s Futures open to test and reject the 23.40 level to then start rallying.

Our trading opportunity came when Silver broke with the previous highs (which were at that moment the daily highs) completing the breakout we were looking for.

The 24.00 level still weighs heavily on Silver and with the DXY (US Dollar currency index) trading above the 94.00 level metals can quickly dip on a USD rally.

Our trade is in full profits with stops at break even almost hitting TP1.

Should Silver break with the 24.10 level (our TP1) it would break with the current bearish structure and we could see price surge to retest the previous weekly highs around the 24.80 level.

Calculated targets on this inverted head and shoulders breakout are at the 24.60 level.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.