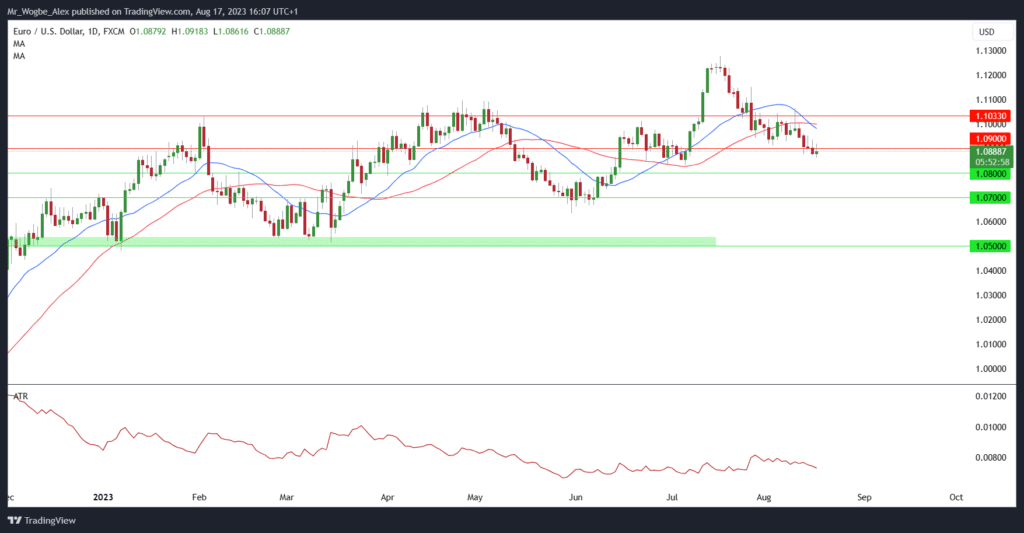

In a surprising twist of fate, the Euro (EUR) has showcased its remarkable resilience by orchestrating a robust and noteworthy recovery against the US Dollar (USD). The EUR/USD currency pair, which had faced adversity with a decline to a six-week low of 1.0861 earlier today, has now defied expectations by rebounding above the psychological barrier at 1.0900.

Conversely, the initial vigor displayed by the Greenback has gradually dissipated, leading to the US Dollar Index (DXY) embarking on a downward trajectory and testing the waters around the 103.00 level.

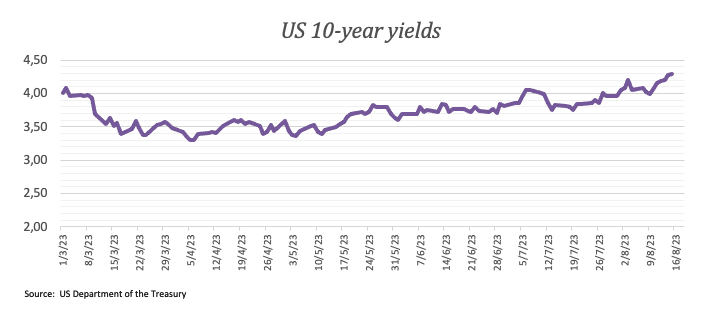

This withdrawal from earlier heights, which saw the US Dollar Index ascend to a six-week peak of 103.59 earlier today, has been primarily attributed to the ongoing upward momentum of US yields, according to FXStreet. That said, the yield curve’s 10-year and 30-year segments have been responsible for driving this trend.

Shift in Euro-Dollar Dynamics Due to Outlook on FOMC Minutes

The shift in sentiment surrounding the EUR/USD pair can be attributed to the keen analysis of the Federal Open Market Committee (FOMC) Minutes by watchful investors. Despite some lingering apprehensions pertaining to inflation-related risks, the overarching sentiment prevailing among numerous market participants leans toward a collective acknowledgment of the potential necessity for implementing further interest rate hikes.

Adopting a broader perspective on prevailing monetary policies, the discourse surrounding the Federal Reserve’s resolute commitment to maintaining a tighter policy stance over a protracted period has rekindled. This strategic approach has been elicited by the steadfast performance of the US economy, even amidst certain indicators pointing to a marginal softening within the labor market and occasional downturns in inflation readings throughout recent months.

In contrast, it is worth noting that internal divisions within the European Central Bank (ECB) have seemingly cast a shadow on the Euro’s current strength. The emergence of discord among the esteemed members of the ECB Council regarding the continuation of tightening measures after the imminent summer period has cast an element of uncertainty, thereby exerting a noticeable drag on the Euro’s current standing.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.