Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Navigating the complexities of storing and managing cryptocurrency can be daunting, especially considering its increasing value and the irreversible nature of transactions. Whether you’re a newcomer or a seasoned investor, this concise guide sheds light on the most secure places to store your digital assets.

Exchanges (Least Secure)

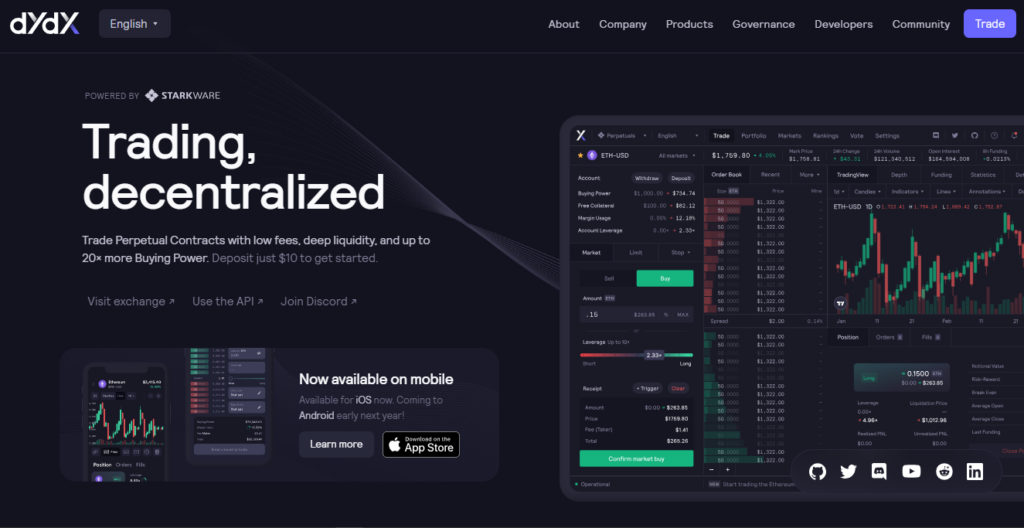

Exchanges, such as Coinbase and Binance, serve as necessary platforms for active traders. However, they pose significant security risks. By pooling crypto assets from all users, exchanges become lucrative targets for hackers. In 2019, Binance fell victim to a $40 million hack, highlighting the vulnerability of centralized exchanges. If using exchanges for trading, limit the funds kept there to what’s necessary for your trades. Alternatively, explore decentralized exchanges (DEXes), like KyberSwap and dYdX, which maintain your control over private keys.

Software Wallets (Somewhat Secure)

For desktop and mobile, software wallets offer an intermediary security solution. While they eliminate the risk of exchange-related mishaps, their safety relies on your device’s security. Storing private keys and recovery phrases offline enhances security. Popular options include Exodus, Jaxx Liberty, Guarda, and Atomic Wallet. These wallets also facilitate asset exchanges but often incur higher fees than centralized exchanges.

Hardware Wallets (Most Secure)

Hardware wallets are the pinnacle of security. They safeguard your private keys within the physical device, preventing their exposure. Additionally, transaction confirmations occur on the device, adding an extra layer of protection. However, they are best suited for long-term holding rather than active trading. Transferring assets to another platform may be required before trading. Despite the cost (starting at $55 for entry-level models like Trezor One), hardware wallets are a worthwhile investment for substantial holdings. Trezor and Ledger are popular choices.

Bonus Tip: Multisignature Wallets

Multisignature wallets, which demand multiple signatures for transaction approval, provide an extra layer of security. These are ideal for collaborative funds but less suitable for everyday use due to their complexity. Electrum and Armory are well-known multisignature wallet options.

Conclusion – Securing Cryptocurrency

Safeguarding your cryptocurrency assets might seem perplexing, given the need to rethink traditional money management. However, this guide aims to bridge knowledge gaps and serve as a quick reference for best practices. Remember that securing your digital wealth is paramount in the ever-evolving world of cryptocurrency.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.