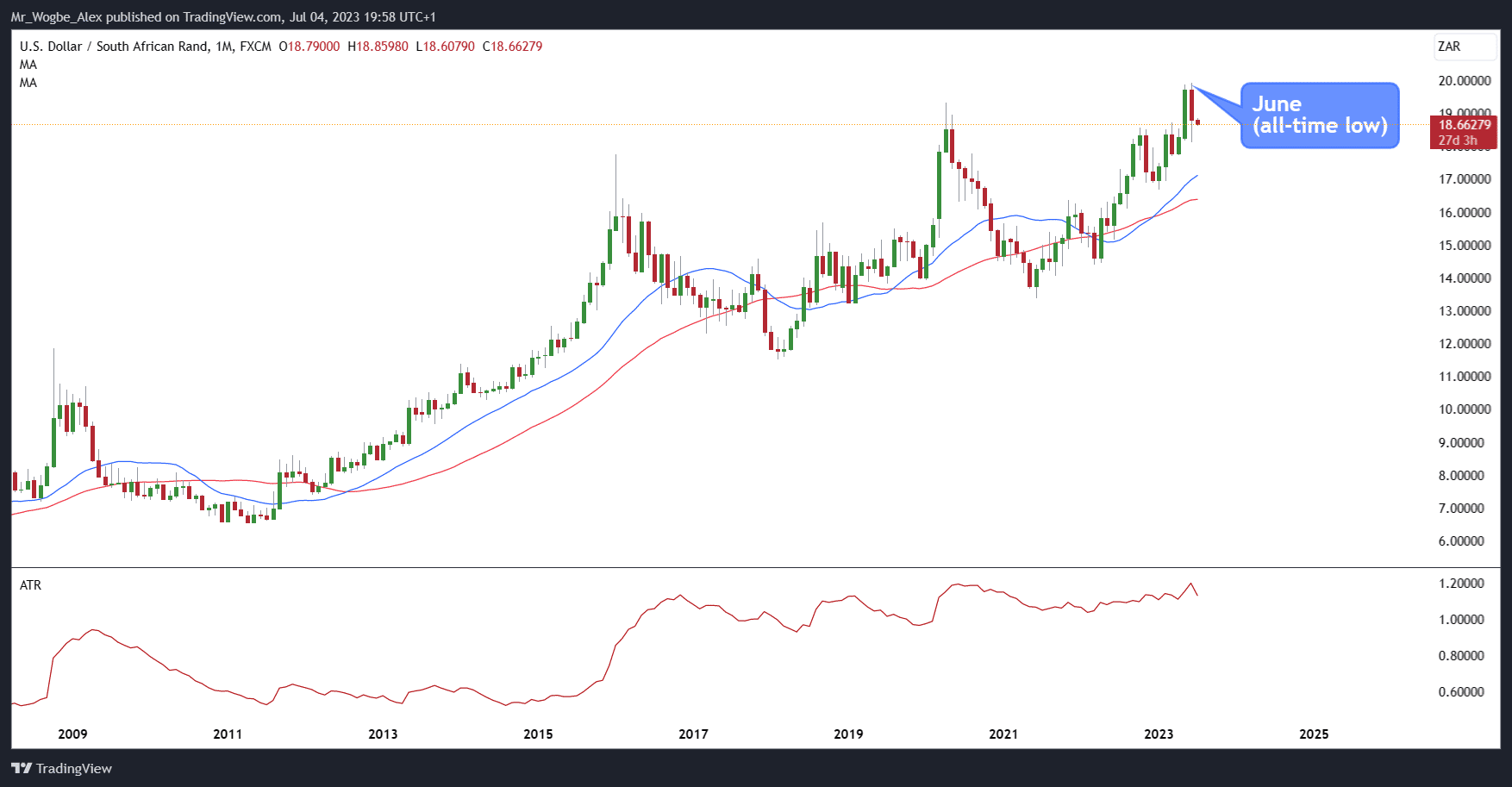

The South African rand (ZAR) has been on a roller coaster ride this year, hitting record lows against the US dollar (USD) in June. The currency faces many challenges, both at home and abroad, that threaten to derail its recovery.

One of the main sources of pressure is the ongoing political and economic turmoil in South Africa. The country suffers from frequent power outages, rampant corruption, and low growth. These factors undermine business confidence and investor sentiment, making the rand vulnerable to shocks.

A recent twist in the plot is the diplomatic spat between South Africa and the West over Russia. South Africa has refused to arrest Russian President Vladimir Putin, who is wanted by several countries for alleged crimes against humanity. This has sparked outrage and threats of sanctions from the US and its allies, which could further damage South Africa’s economy and currency.

SARB’s Hawkish Stance: An Attempt to Bolster the Rand

To counter the rand’s weakness, the South African Reserve Bank (SARB) has been raising interest rates aggressively. The central bank aims to curb inflation and protect the currency’s value, which are among its main mandates.

The higher interest rates make the rand more attractive for foreign investors, who can earn higher returns by holding the currency. This is known as the carry trade, and it could provide some support for the rand in the third quarter of 2021.

USD’s Uncertain Outlook

Another key factor influencing the rand is the performance of the USD, which is the world’s reserve currency. The USD has been strengthening this year as the US economy recovers from the pandemic and the Federal Reserve hikes interest rates.

However, the USD’s rally may be losing steam as the Fed signals a pause in its tightening cycle. The Fed chair, Jerome Powell, has said that future rate hikes will depend on incoming data, which has been mixed lately. The US labor market and inflation have shown signs of slowing down, which could limit the Fed’s scope to raise rates further.

If the USD weakens, it could ease some of the pressure on the rand and other emerging market currencies. However, this may not be enough to offset the other headwinds facing the rand, which remain formidable.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.