The U.S. dollar weakened on Friday after a report showed that consumer spending, the main driver of the economy, barely rose in May while inflation moderated slightly.

According to the Commerce Department, personal consumption expenditures (PCE) edged up by 0.1% month-over-month in May, missing the consensus estimate of 0.2%. On a year-over-year basis, PCE increased by 3.8%, down from 4.0% in April.

source: tradingeconomics.com

Personal income, on the other hand, rose by 0.4% month-over-month in May, beating the forecast of 0.3% and reversing a 0.3% decline in April. The increase in income was mainly driven by higher wages and salaries as the labor market continued to recover.

The report also showed that the PCE price index, the Fed’s preferred measure of inflation, rose by 0.3% month-over-month in May, matching market expectations. However, on an annual basis, the core PCE index, which excludes food and energy prices, eased to 3.6% from 3.7%, slightly below the forecast of 3.7%.

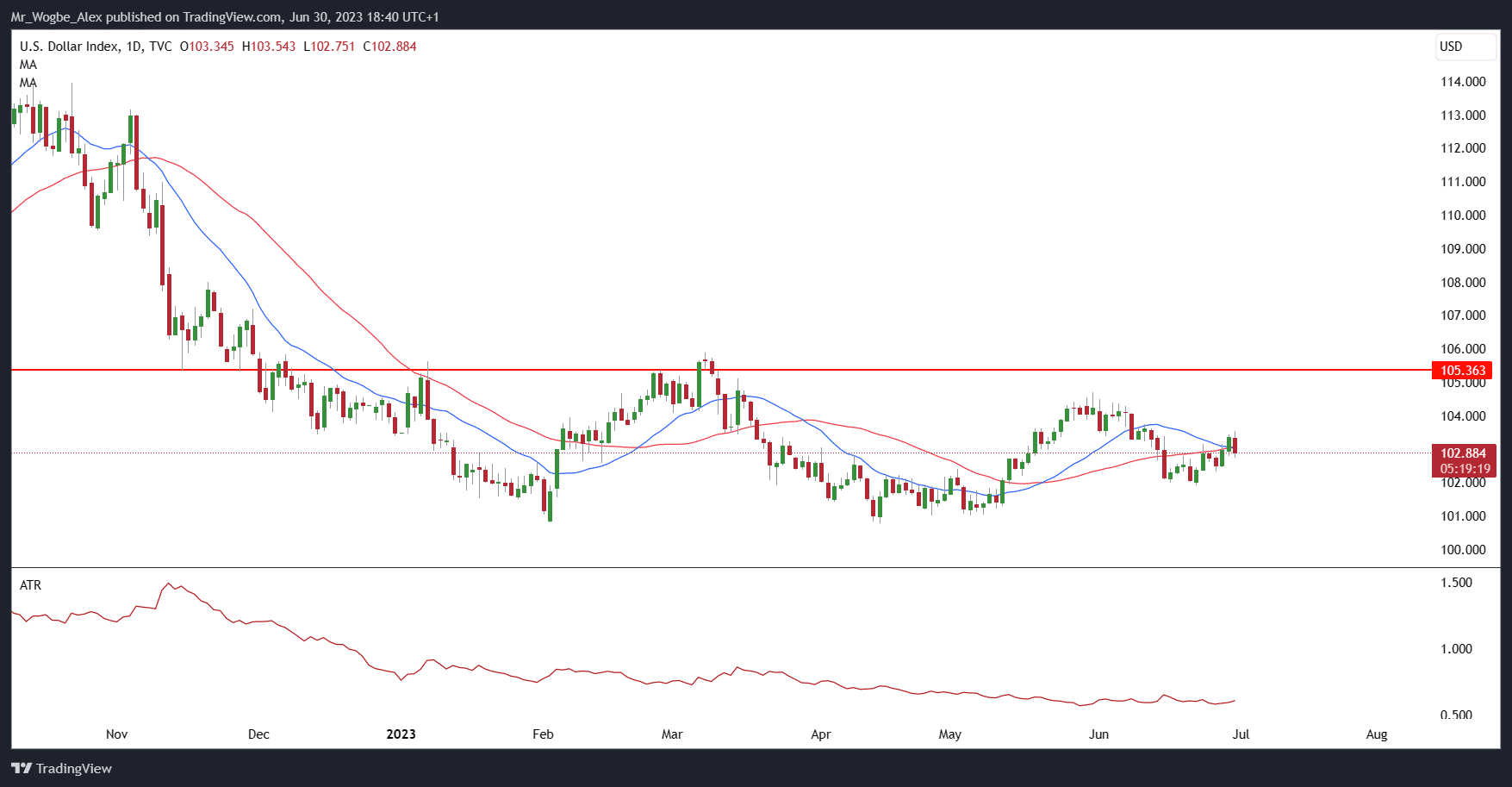

Dollar Falls Below 103, Ending Two-Day Bullish Streak

The softer-than-expected consumer spending and inflation data may give the Fed some breathing room to maintain its accommodative stance and avoid a premature tapering of its bond-buying program. While the central bank may still hike interest rates by 25 basis points in July, as signaled by its latest dot plot, a September hike may be off the table for now. That said, the situation could limit Treasury yields in the near-to-medium term, creating the perfect combination for a dollar pullback.

The dollar, as measured by the DXY index, fell by 0.5% to 103.75 after the release of the report, while Treasury yields also retreated across the board. The greenback may face further downside pressure if upcoming data confirms that the U.S. economy is cooling off from its post-pandemic boom.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.