In the latest report by the Bureau of Economic Analysis, the US GDP (gross domestic product) for the first quarter of 2023 showed a modest increase of 2.0 percent, outpacing the previous quarter’s growth rate of 2.6 percent. The revised estimate, based on more comprehensive and reliable data, exceeded earlier expectations of a mere 1.3 percent rise.

source: tradingeconomics.com

Thanks to some positive adjustments in exports and consumer spending, the GDP estimate received a welcome boost. However, not everything was smooth sailing, as nonresidential fixed investment and federal government spending faced downward revisions. On the bright side, imports, which are deducted from the GDP calculation, saw a downward revision as well.

Contributing Factors to US Gross Domestic Product Growth

Various factors played a role in the growth of real GDP during the first quarter. Consumer spending saw a notable uptick, alongside a rise in exports, sub-national government spending, federal government spending, and nonresidential fixed investment. Unfortunately, private inventory investment and residential fixed investment experienced declines, tempering the overall growth. Moreover, the increase in imports impacted the final GDP figure.

While the first quarter displayed moderate growth, the future economic landscape remains uncertain. Factors such as global trade tensions, geopolitical events, and the unpredictable sway of consumer sentiment could all impact future GDP growth. As we cautiously navigate the path ahead, keeping a watchful eye on these indicators will be essential to determining whether the economy continues its upward trajectory or encounters challenges.

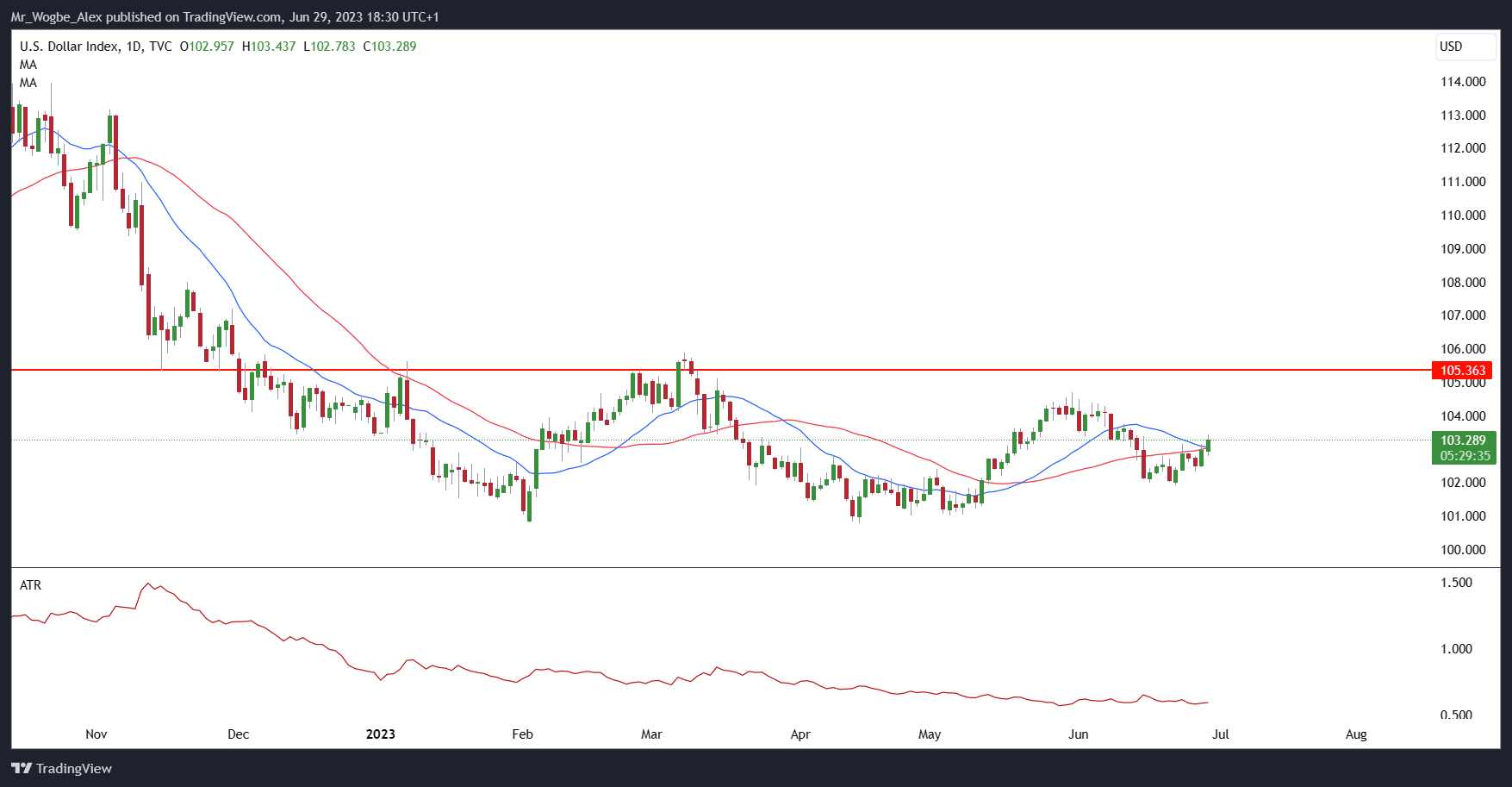

DXY Trades Steady at 103.30, Unfazed by US GDP Report

Interestingly, the recent GDP report seems to have had little impact on the US dollar, as the Dollar Index (DXY) trades steadily at 103.30. It appears that other market dynamics are at play, keeping the currency unaffected by the GDP figures. As traders and investors keep a keen eye on the ever-shifting economic landscape, they will continue to monitor a range of factors that could influence the dollar’s performance.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.