In a surprising turn of events, the U.S. dollar displayed remarkable resilience in the face of Fitch’s recent credit rating downgrade from AAA to AA+. Despite the move drawing an angry response from the White House and catching investors off-guard, the dollar barely budged on Wednesday, indicating its enduring strength and prominence in the global financial landscape.

Fitch’s decision to downgrade the United States’ credit rating was based on concerns regarding the country’s fiscal health over the next three years. The agency highlighted the recurring last-minute debt ceiling negotiations, which have raised doubts about the government’s ability to meet its financial obligations efficiently. While this news would typically have significant repercussions on the currency’s value, the dollar’s response was relatively subdued.

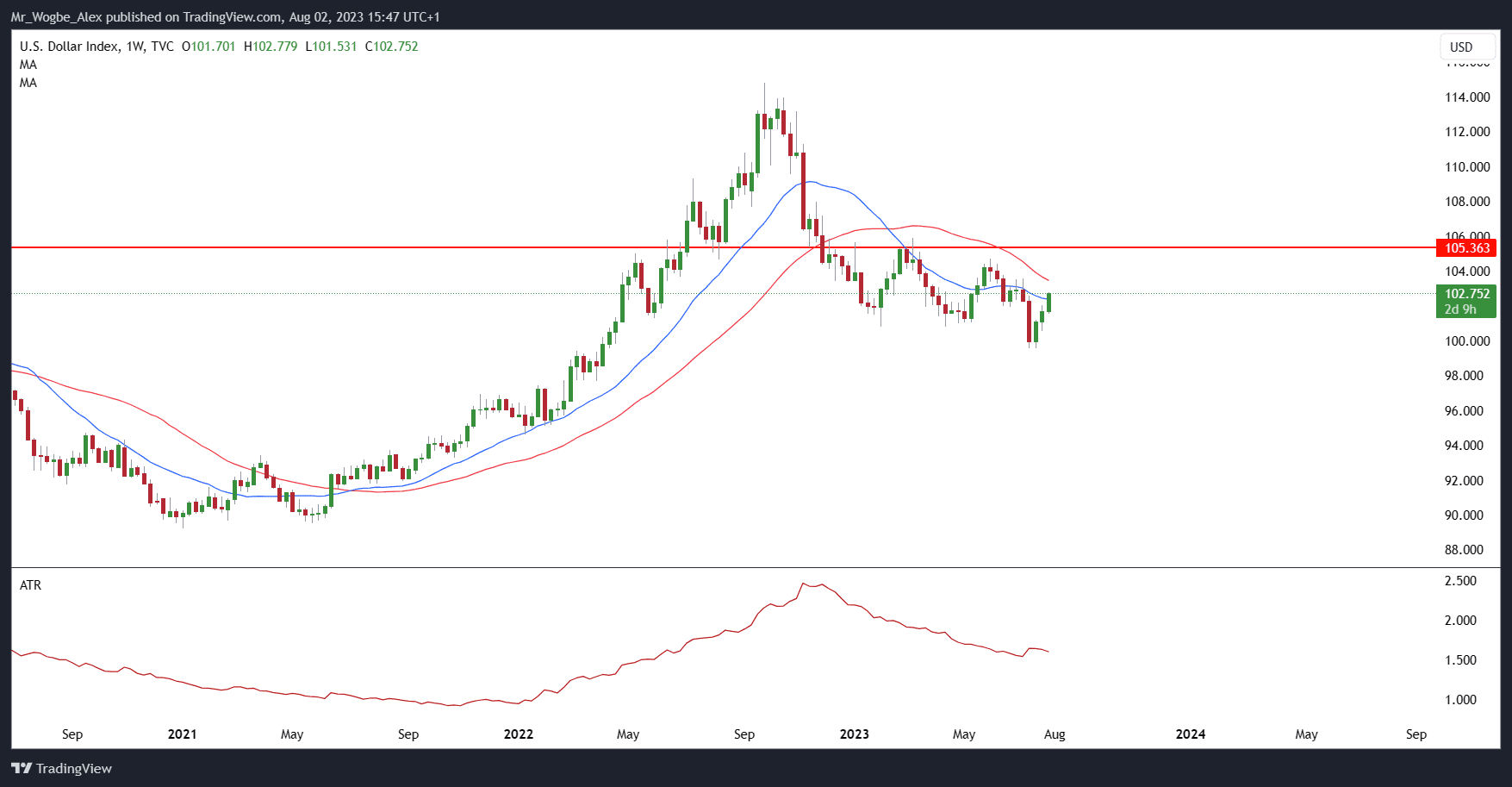

The euro, the world’s most traded currency pair against the dollar, experienced a sharp decline of about 0.57%, settling at $1.0921 as of writing. Similarly, the dollar index, which tracks the currency against six major peers, gained 0.8%, standing at 102.74. This performance was particularly noteworthy as it came close to touching Tuesday’s three-week high.

Safe Haven Status Saves the Dollar

One key factor that appears to have bolstered the dollar’s resilience is its status as a safe-haven asset. During periods of uncertainty and market turbulence, investors tend to flock to assets perceived as safer stores of value. In this case, despite Fitch’s downgrade, the dollar retained its allure as a reliable and stable option for investors seeking shelter from the storm.

According to Reuters, the Head of FX Strategy at Rabobank pointed out that even when confronted with negative news, businesses and individuals worldwide tend to rely on the dollar to fulfill their financial obligations. The global prominence of the dollar and its extensive use in international trade and finance ensure its continued demand, acting as a buffer against drastic fluctuations.

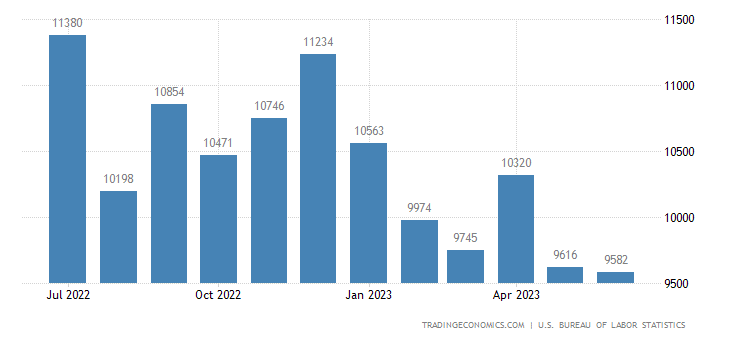

Furthermore, the dollar found additional support from positive economic indicators. Recent reports indicated that U.S. job openings remained steady, suggesting a tight labor market.

Although job openings experienced a slight dip to a two-year low in June, another separate report suggested that U.S. manufacturing might be stabilizing, even though at comparatively weaker levels. These optimistic economic signals contributed to the dollar’s stability and were well-received by investors.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.