In a Reuters poll of currency experts, the Indian rupee is expected to maintain a narrow trading range against the US dollar in the upcoming year. Despite the dollar’s recent weakness and India’s robust economic growth, the rupee has lingered near its record low of 83.47 per dollar, reached on November 10.

The Reserve Bank of India (RBI) plays a pivotal role in this stability, frequently intervening in the foreign exchange market to curb volatility. The RBI’s strategic buying of dollars aims to bolster foreign exchange reserves and support the nation’s exports.

Anticipation of the US Federal Reserve lowering interest rates in 2024 has softened the dollar’s strength, favoring emerging market currencies. However, the rupee has yet to capitalize on this weakness, trading at its current level of 83.35.

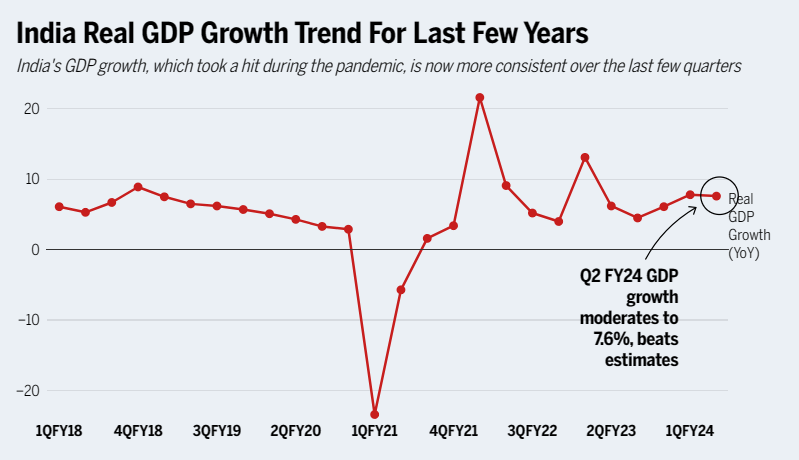

According to the Reuters poll, currency experts predict the rupee to trade at 83.30 by the end of December and 83.23 by the end of March. Despite India’s economic growth outpacing its peers at 7.6% in the last quarter, nearly one-third of analysts expect the rupee to hit a new all-time low by the end of this month.

Commenting on the impressive GDP performance, India PM Narendra Modi tweeted that the growth reflected the resilience and strength of the economy in the face of tough global economic realities.

The GDP growth numbers for Q2 display the resilience and strength of the Indian economy in the midst of such testing times globally. We are committed to ensuring fast paced growth to create more opportunities, rapid eradication of poverty and improving ‘Ease Of Living’ for our…

— Narendra Modi (@narendramodi) November 30, 2023

Looking ahead, the rupee is projected to appreciate marginally to 82.80 by the end of 2024, reflecting a modest gain of about 0.6% from its current level. Most strategists believe the RBI will continue its interventions, with only two analysts foreseeing a potential easing within the next three months.

Rupee Could Benefit from Fed Rate Cuts

However, some analysts suggest the rupee could benefit from a weaker dollar in the coming year if the Federal Reserve initiates rate cuts sooner than expected. With the Fed fund futures currently pricing in a rate cut as early as March 2024, the dynamics of the rupee-dollar relationship remain a focal point for market watchers.

In summary, the rupee’s resilience, coupled with the RBI’s strategic interventions, is poised to navigate the currency through the uncertainties of global markets, offering a steady course amid potential challenges.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.