In a concerning turn of events, the Russian ruble finds itself in a precarious position, hitting a new 16-month low on Wednesday. The currency’s recent woes can be attributed to a combination of factors, with robust foreign currency demand and a limited supply acting as the primary culprits. These challenges are further compounded by Russia’s shrinking trade surplus and the widening budget deficit, which have collectively dampened market sentiment.

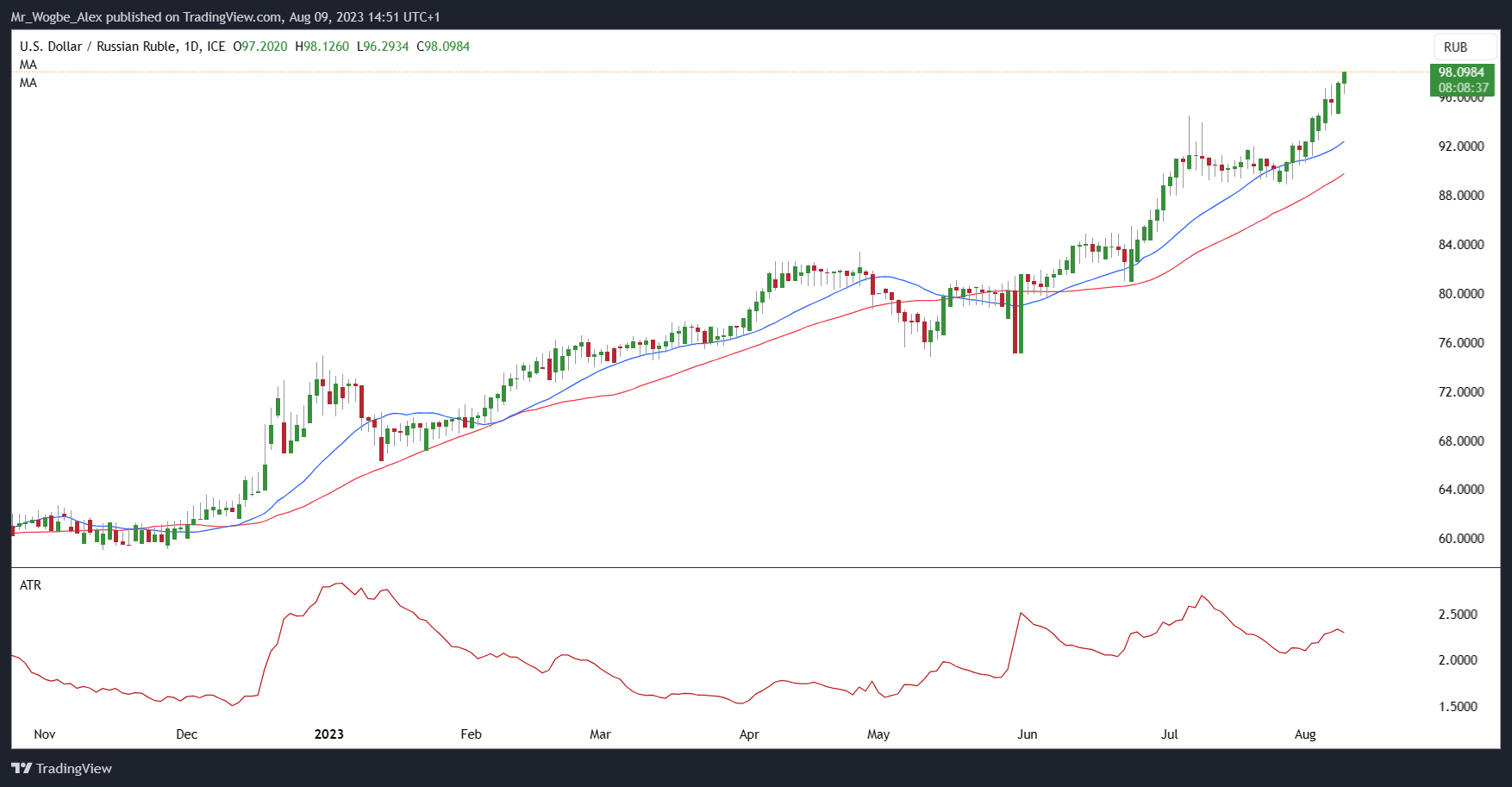

As of the time of writing, the ruble displayed a 0.95% weakening against the dollar as the USD/RUB pair surged to 98.10, its highest mark since March 2022. The ruble’s struggles extended beyond the dollar, as it experienced a 0.94% loss against the euro, leading to a trading rate of 107.50.

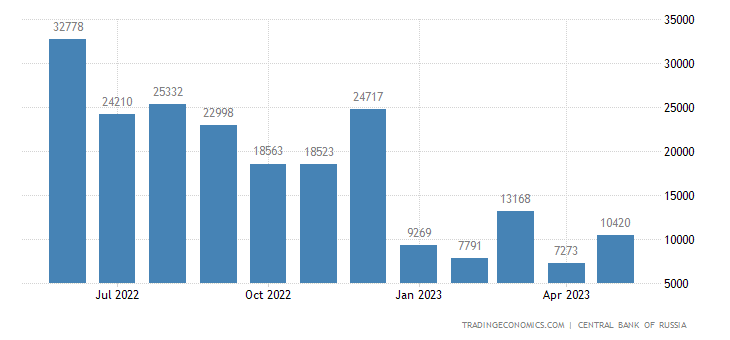

According to Reuters, Egor Zhilnikov, an astute analyst from Promsvyazbank, highlighted the crucial role of limited foreign currency supply from exporters in this scenario. The scarcity of foreign currency is rooted in challenges related to repatriating funds and reduced export availability. This scarcity has, understandably, applied considerable pressure on rouble positions, driven by a consistent demand among importers.

Ruble Suffers Hefty Crash Against the Dollar in August

The month of August has proven to be particularly challenging for the ruble, witnessing a 7.6% depreciation against the dollar. This setback followed the cessation of support from the typical month-end tax period, during which exporting firms convert foreign exchange earnings to fulfill their local liabilities.

Throughout the year, the ruble has been navigating the rough waters of Russia’s contracting trade balance. The decline in export revenues coupled with an uptick in imports has contributed to a notable year-to-date decrease of approximately 35%. This slide has pushed the ruble from levels that were once hovering close to 70 to the dollar.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.