The cryptocurrency market has seen massive crypto inflows reach $2.2 billion last week, pushing the total assets under management to over $100 billion. This surge comes as investors react to potential changes in the U.S. political landscape, though recent data suggests some profit-taking has begun.

Understanding the Pattern of the Recent Crypto Inflows

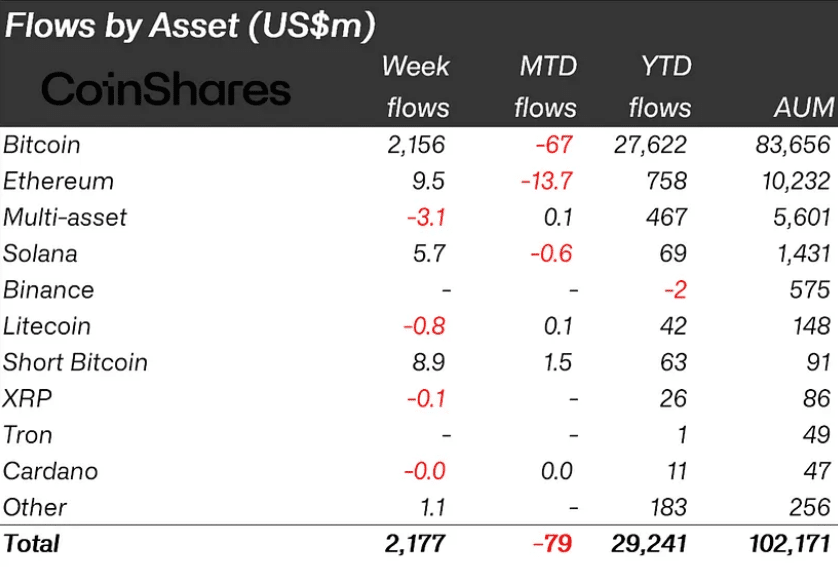

Bitcoin grabbed the lion’s share of investor interest, drawing nearly all of the $2.2 billion in weekly inflows, according to the latest CoinShares report. This pushed the year-to-date inflows to an all-time high of $29.2 billion. Trading activity also picked up significantly, with weekly volumes jumping 67% to $19.2 billion.

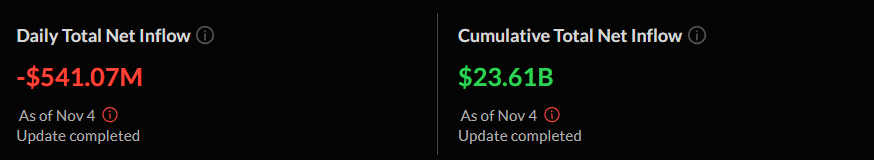

However, Monday’s data shows a different picture. Spot Bitcoin ETFs recorded their second-largest daily outflow since January, with $541 million leaving these funds. Fidelity’s FBTC led the exodus with nearly $170 million in outflows, while BlackRock’s IBIT bucked the trend by attracting $38.42 million in new investments.

Market Response to Political Uncertainty

Regional investment data reveals that U.S. investors dominated the inflow activity, contributing $2.2 billion, while German investors added a modest $5.1 million. The flow patterns suggest strong ties to political sentiment, with early-week enthusiasm giving way to caution as election polls shifted.

Other cryptocurrencies showed varied performance. Ethereum attracted just $9.5 million in weekly inflows, displaying much less momentum than Bitcoin or Solana. The latter continued its positive streak with additional inflows of $5.7 million. Smaller cryptocurrencies like Polkadot and Arbitrum also saw minor positive flows.

The current market dynamics highlight how closely crypto investments are tied to U.S. political developments. With total ETF trading volumes reaching $2.22 billion on Monday and Bitcoin’s price hovering around $68,000, investors appear to be positioning themselves ahead of both election results and upcoming Federal Reserve decisions.

This shifting landscape suggests that while overall sentiment remains positive, investors are becoming more selective in their crypto investments, carefully weighing political and economic factors before making decisions.

The contrast between record weekly inflows and subsequent daily outflows indicates a market that’s both optimistic about long-term prospects and mindful of short-term risks.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.