As the United States heads to the polls, Bitcoin traders are watching key market indicators that could signal major price movements. Recent data from Kaiko Research highlights how crypto markets are preparing for potential election-related volatility, with Bitcoin’s price movements catching particular attention.

How Bitcoin Derivatives Markets Are Positioning

The futures market tells an interesting story about trader sentiment.

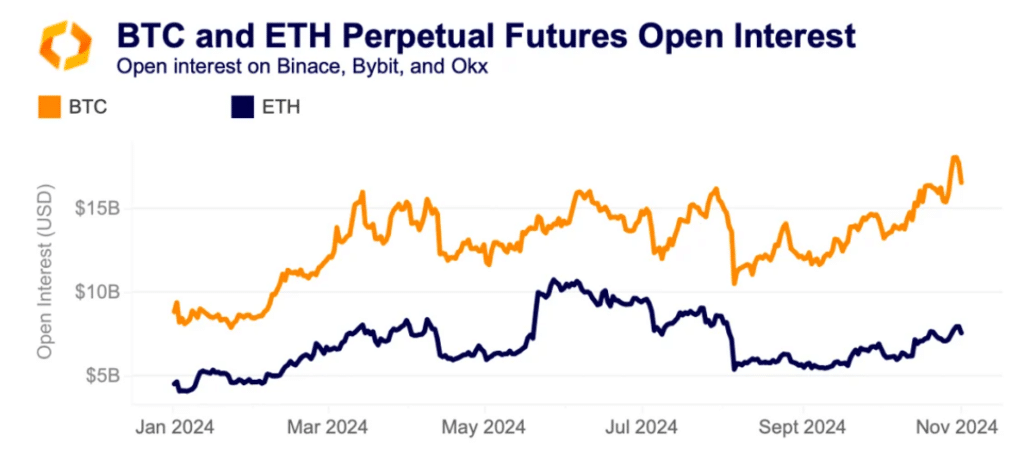

Bitcoin’s perpetual futures saw record-high open interest at October’s end, jumping by over $2 billion since August.

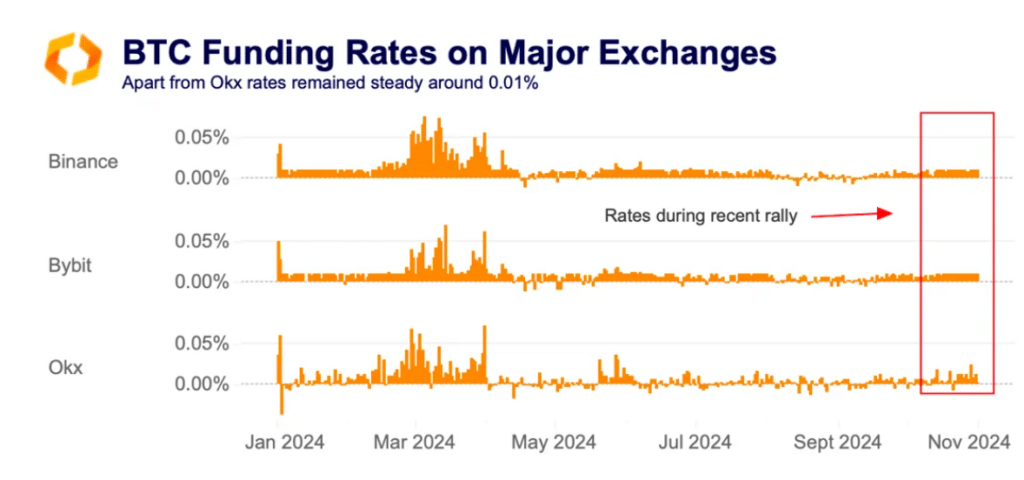

However, funding rates have stayed surprisingly steady at around 0.01% on major exchanges like Binance and Bybit.

This suggests traders are being cautious rather than making big bets ahead of the election.

Bitcoin’s Market Dynamics Under the Microscope

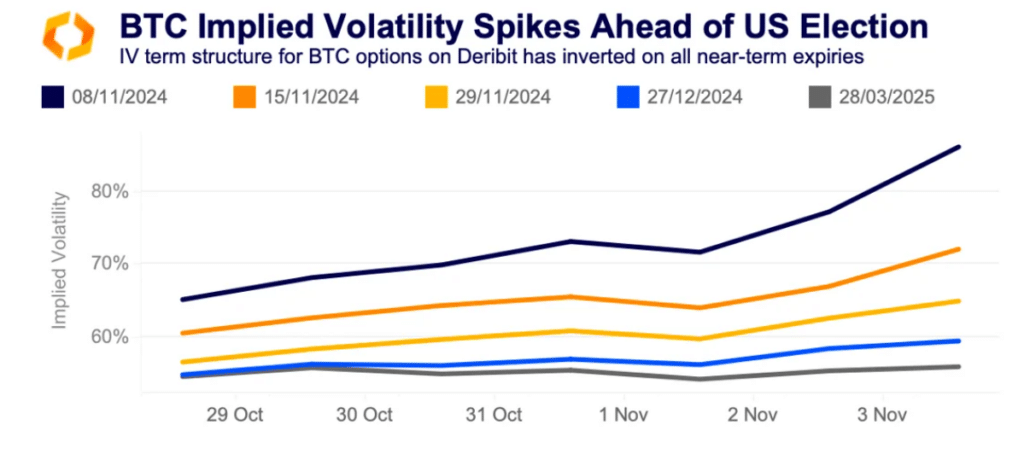

Options markets paint a picture of growing uncertainty. The implied volatility (IV) curve has shifted notably, with traders paying more for protection against price drops.

This defensive positioning shows that market participants are preparing for possible election-night surprises. Importantly, crypto markets will keep trading while traditional U.S. markets are closed during vote counting, which could lead to sharp price moves as results come in.

Key states to watch for market reactions include Pennsylvania, Georgia, and Michigan, as early results from these regions could trigger quick market responses. Pennsylvania’s outcome is particularly important, as its 19 electoral votes could strongly influence market sentiment.

Looking beyond election night, several factors could affect Bitcoin’s price in the coming months. These include potential new stablecoin regulations and decisions on spot ETF applications for various cryptocurrencies. The election’s impact on these regulatory matters could shape Bitcoin’s long-term trajectory.

Market watchers should pay special attention to trading volumes and price movements during key vote-counting periods.

The first significant market reactions might come after Georgia’s early voting results, which are required to be counted by 8 PM EST. Traders should also watch for updates to funding rates, which occur every eight hours on major exchanges, potentially triggering price movements as election results become clearer.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.