The crypto markets are showing interesting patterns as the United States approaches its presidential election in November. According to recent Kaiko research, both retail and institutional traders are taking calculated positions, with Bitcoin derivatives seeing increased activity.

This marks the first time crypto has emerged as a significant campaign topic, with candidates taking clear stances on digital assets.

How Crypto Markets Are Positioning for Election Outcomes

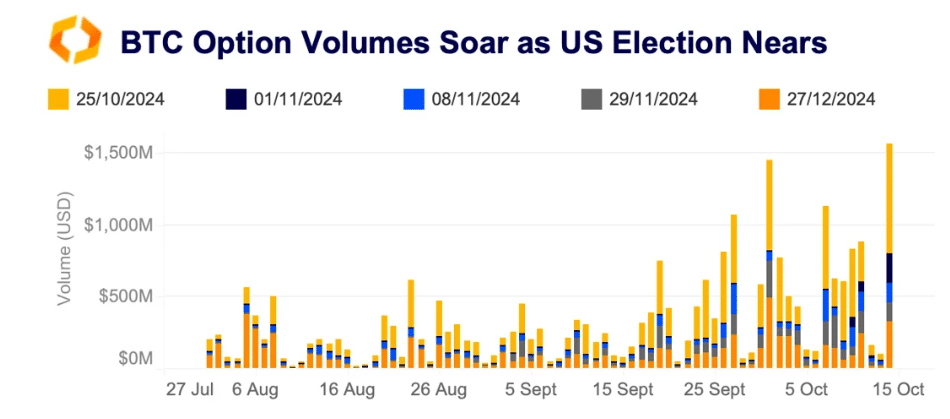

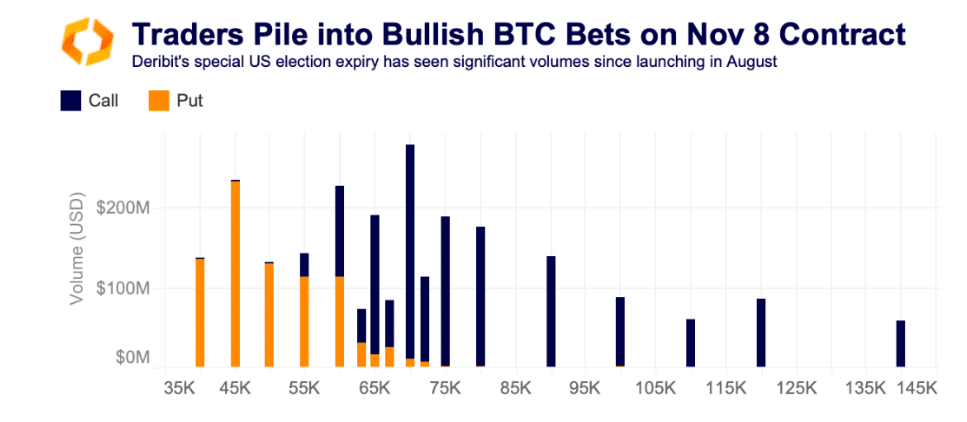

Trading data reveals a surge in Bitcoin options activity on Deribit, particularly around late October and early November expiries. Large institutional traders have shown special interest in the November 8 election-specific contract, with trading volumes reaching $3 billion since August.

Most traders are placing bullish bets in the $65,000 to $80,000 range, suggesting expectations of record-high prices after the election.

A notable trading strategy emerging among investors is the long strangle option, where traders buy both call and put options. This approach aims to profit from expected market volatility around the election, regardless of price direction. The strategy has gained popularity due to the uncertain nature of the election outcome and its potential impact on crypto prices.

Traditional Market Signals and Their Impact on Crypto

Bitcoin ETF activity provides additional insights into market sentiment. The Chicago Mercantile Exchange (CME) has reported consecutive record highs in Bitcoin futures open interest over recent weeks. This surge in institutional involvement suggests growing confidence in the crypto market despite election uncertainty.

The U.S. Treasury market is also sending important signals. The 10-year Treasury yield has increased since late September, potentially reflecting market reactions to campaign promises. For instance, Donald Trump’s proposed tariff policies could drive inflation, which many traders believe could benefit Bitcoin as a hedge.

While prediction markets like Polymarket have gained attention, their relatively low liquidity ($250 million maximum open interest) suggests they may not be reliable indicators of election outcomes or market direction. Instead, established crypto derivatives markets, with their higher liquidity and institutional participation, offer more reliable insights into market expectations.

The research indicates that regardless of the election winner, traders are positioning for potential upward momentum in crypto prices. However, short-term volatility is expected around the election date, creating both risks and opportunities for market participants.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.