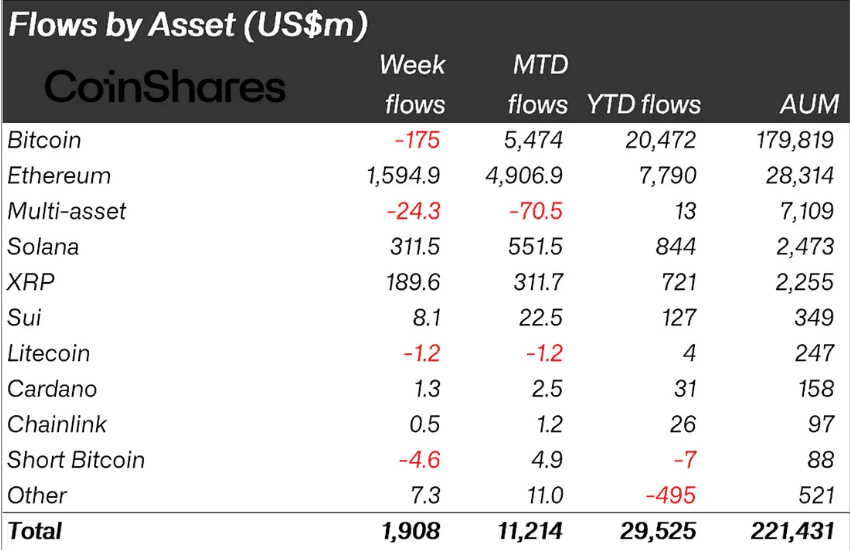

Digital asset markets experienced unprecedented momentum last week, with crypto inflows reaching $1.9 billion and pushing monthly totals to a record $11.2 billion.

According to the latest CoinShares report, this surge represents the fifteenth consecutive week of positive investor sentiment. This significantly outpaces the $7.6 billion recorded in December 2024 following the US presidential election.

Ethereum emerged as the primary beneficiary of this capital migration, attracting $1.59 billion in weekly inflows—its second-strongest performance on record.

Year-to-date flows into Ethereum products have now reached $7.79 billion, surpassing the entire 2024 total. This performance contrasts sharply with Bitcoin, which experienced minor outflows of $175 million despite the broader market enthusiasm.

Regional Distribution Patterns in Crypto Inflows

Geographic analysis reveals mixed regional performance. The United States dominated with $2 billion in inflows, while Germany contributed $70 million.

However, several markets showed capital flight, including Brazil ($23.2 million outflows), Canada ($84.3 million), and Hong Kong ($160 million). This divergence suggests varying regulatory environments and investor confidence levels across jurisdictions.

Alternative Assets Gain Institutional Attention

The current market cycle extends beyond Ethereum, with several alternative cryptocurrencies capturing significant institutional interest. Solana secured $311 million in inflows, while XRP attracted $189 million. Even smaller tokens like SUI recorded $8 million in new investments.

Market analysts attribute these patterns to anticipated regulatory developments, particularly potential US ETF approvals for alternative cryptocurrencies.

This institutional preparation may explain the divergent performance between established assets and emerging alternatives.

Ethereum Validators Exit Queue Reach Record Level

In related news, the Ethereum validator exit queue simultaneously reached historic levels at 744,000 validators, primarily due to liquidity pressures in decentralized finance protocols.

According to The Block, Aave’s borrowing rates spiked from 3% to double digits after $630 million in withdrawals, forcing leveraged positions to unwind and creating additional selling pressure on liquid staking tokens.

These developments suggest institutional portfolios are actively rebalancing toward Ethereum-based products while maintaining selective exposure to high-conviction alternative assets.

The sustainability of these flows will likely depend on regulatory clarity and continued institutional adoption rates.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.