The Ethereum network is facing unprecedented demand as both entry and exit validator queues have swollen to record levels following the cryptocurrency’s recent price surge.

The exit queue now holds approximately 521,000 ETH worth $1.9 billion, marking the highest levels since early 2024, while 359,500 ETH valued at $1.3 billion awaits entry into the staking system.

This validator congestion reflects two competing forces within the network. Exit wait times have stretched to eight or nine days, the longest period in over a year, as some validators look to capitalize on Ether’s remarkable 162% recovery from April lows.

Simultaneously, fresh capital continues flowing into the network, driven by institutional appetite and regulatory clarity from recent SEC guidance.

Ethereum ETF Inflows Drive Institutional Adoption

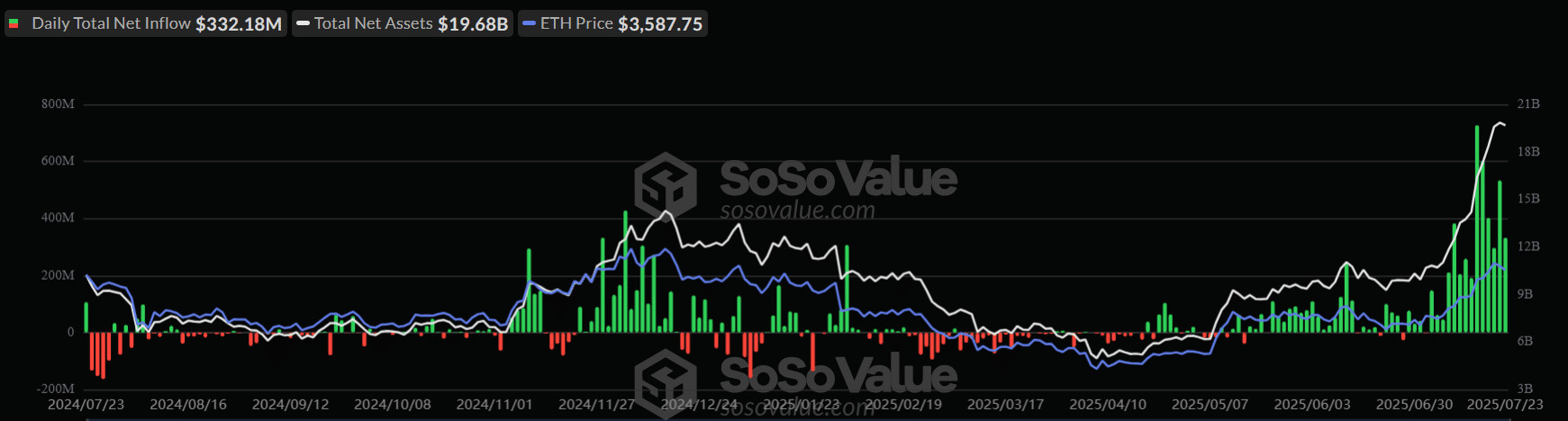

Meanwhile, exchange-traded funds have emerged as a primary catalyst for Ethereum’s current momentum.

Since mid-May, spot ETH products have accumulated over $5 billion worth of tokens, with Tuesday alone recording $534 million in inflows—the third-largest single-day figure since launch.

BlackRock’s iShares Ethereum Trust led these inflows with $426 million, while Grayscale’s Mini Trust attracted an additional $72.6 million.

Corporate treasury strategies have also contributed significantly to demand. Companies including SharpLink Gaming, BitMine Immersion, and Bit Digital have announced substantial ETH holdings as part of their treasury diversification plans.

This institutional shift mirrors Bitcoin’s 2024 trajectory, where similar demand patterns drove significant price appreciation.

Supply-Demand Imbalance Creates Market Dynamics

The current market structure reveals a stark imbalance between supply and demand fundamentals.

Since May 15, ETFs and corporate buyers have purchased approximately 2.83 million ETH—32 times more than the network’s new issuance during the same period. This ratio creates sustained upward pressure on prices, with analysts projecting a potential continuation of this trend.

Network participation has reached new heights, with 29.4% of the total ETH supply now staked—an all-time record representing 36.39 million coins.

This growing participation rate demonstrates increasing confidence in Ethereum’s proof-of-stake mechanism and the attractive yield opportunities it provides to long-term holders seeking passive income generation.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.