The battle which raged on for almost two years reached a crescendo after the Internet & Mobile Association of India (IAMAI), a non- profit related agency which protects the rights of internet consumers and investors alike brought the matter before Supreme Court.

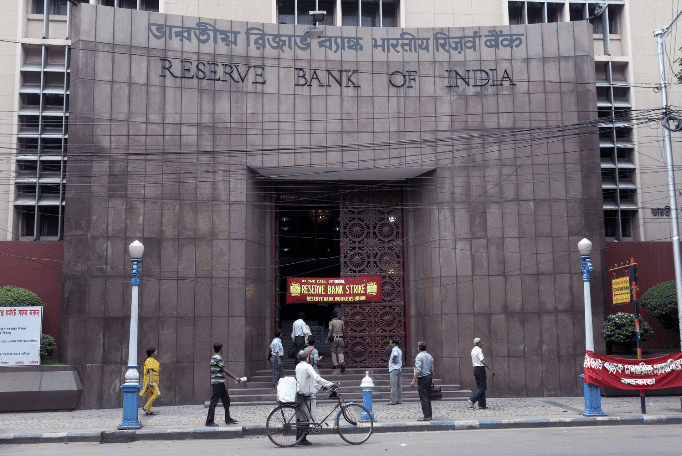

On March 4, 2020, in a two hearing proceeding that occurred earlier this year in January, the Supreme Court made void the apex bank’s blanket rule on the crypto companies. In a launch back response, the RBI is seeking that grounds be shifted in the Supreme Court ruling.

RBI Needs Evidence to Support Its Claims

RBI had claimed that cryptocurrency trading had detrimental effects on the banking sector, to which it had no substantial evidence. The Supreme Court is unlikely to shift grounds if the RBI failed to produce substantial evidence to its claims. Also, the central bank’s agitation that cryptocurrency trade may increase in the country was quite debatable as many crypto firms in India started using fiat exchange in their transactions immediately the Supreme Court made void the controversial rule.

RBI seems to be in a bigger dilemma as it is apparent that the crypto firms who were forced to shut down as a result of what was termed an “insensitive ban” will press charges seeking compensation.

A law consultant to one of the affected firms stated that while it was good for cryptocurrency companies to commence activities almost after two years of the ban, but another paramount fact to note is how to cater for the losses incurred when these companies were halted forcefully, he hinted that the firms may seek a redress along this line.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.