Bitcoin, the premier cryptocurrency, experienced a volatile trading session today, showcasing a 3.9% gain before retracing its steps.

This fluctuation aligned with a broader recovery seen in major stock indices, prompted by a robust U.S. jobs report signaling a strong domestic economy. However, uncertainties arose regarding anticipated interest rate adjustments.

On Wall Street, stocks rebounded strongly following Thursday’s dismal performance, touted as the worst session in months. The S&P 500 (SPX) surged by 1%, the Dow Jones Industrial Average (DJI) climbed by 296 points or 0.78%, and the Nasdaq Composite Index (IXIC) advanced by 1.4%.

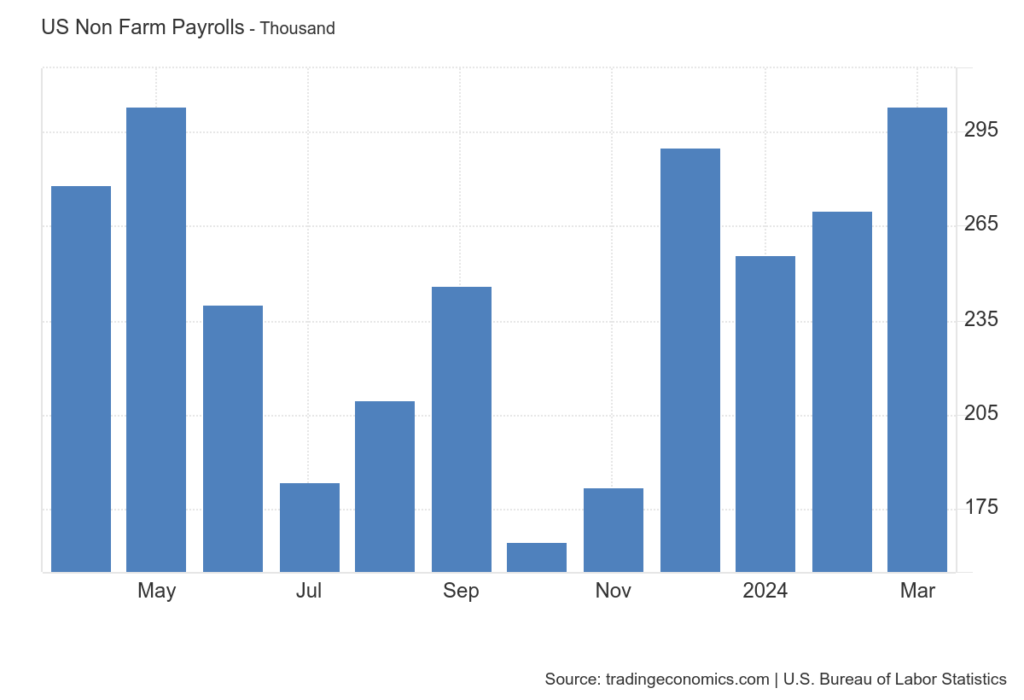

March’s labor market figures surpassed expectations, with U.S. employers adding a staggering 303,000 jobs, well above the anticipated 200,000.

This robust performance hints at the economy’s resilience despite looming interest rate pressures, possibly influencing the Federal Reserve to maintain rates for a longer period.

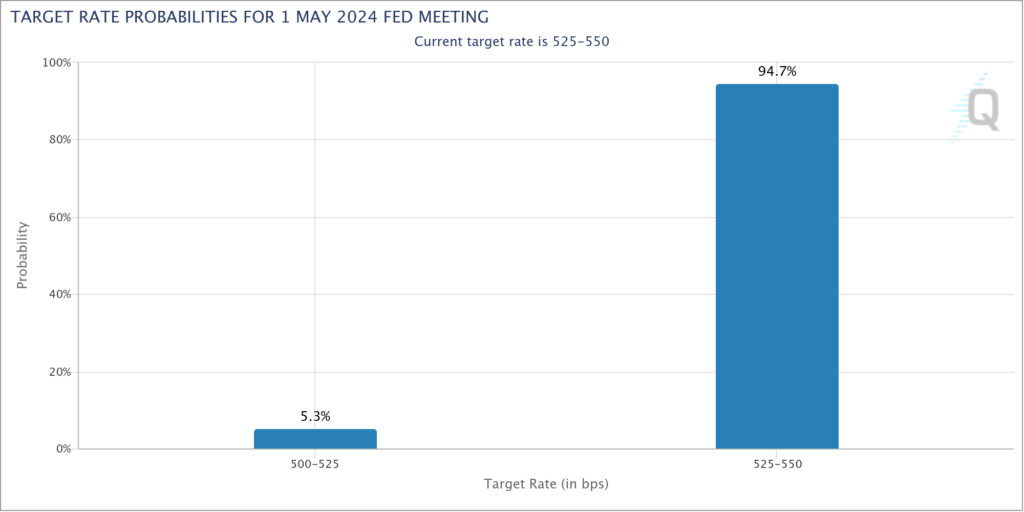

CME’s FedWatch tool indicates a near 95% confidence among traders that the Fed will maintain current interest rates in May, with a little over 53% probability of a rate cut in June.

The strong job growth coupled with low unemployment rates could drive wage and price increases, potentially spurring inflation. In response, the Federal Reserve might favor maintaining rates to avert overheating.

Rate-Cut Doubts Loom Over Bitcoin

However, doubts loom over an imminent rate cut, with prevailing macroeconomic conditions potentially fostering a risk-off sentiment that could impact risk assets like Bitcoin.

The Block reports that Richmond Federal Reserve President Thomas Barkin urged caution, advocating for a patient stance until the inflation outlook is clarified, especially amidst high inflation readings in early 2024.

At present, Bitcoin is trading down by 1.3% at 67,630, showcasing the intricate relationship between cryptocurrency markets and traditional economic indicators and underscoring Bitcoin’s resilience amidst economic optimism and policy uncertainties.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.