Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Quant Price Forecast: August 5th

Quant price forecast shows that bears are still gaining ground as buyers fight back.

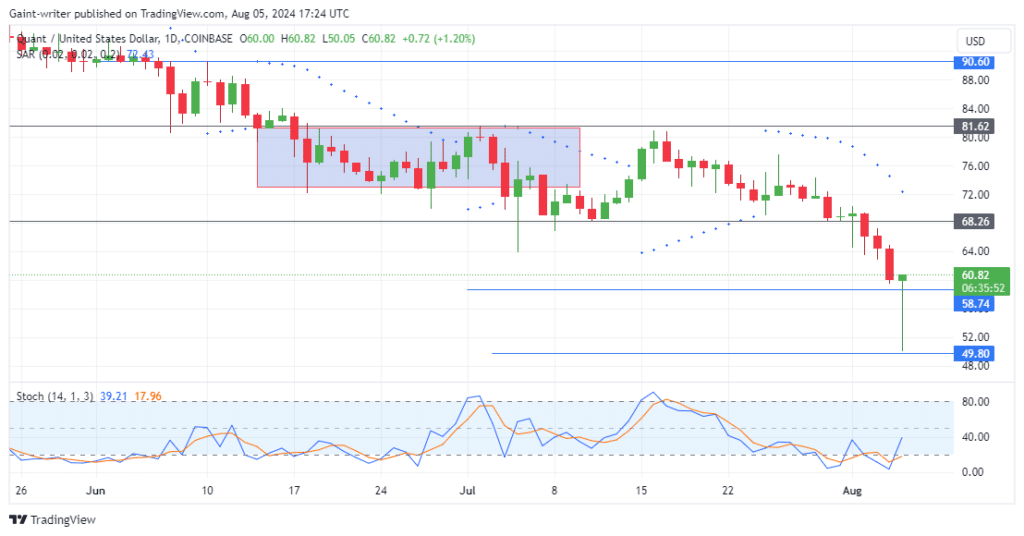

QNTUSD Long Term Trend: Bearish (1-Day Chart)

Key Levels

Support Levels: $90.600, $81.620

Resistance Levels: $68.260, $58.740

Quant Price Forecast: QNTUSD Outlook

The recent price action this week has showcased a sharp display of liquidity purge, with buyers currently picking up pace to fight back. Earlier, starting in July, buyers had a rough start, only to push the price up to the $81.620 key level. However, sellers eventually stepped in, managing to break through the $68.260 significant level. August also started with a bearish drift as sellers gained more ground, ultimately breaching the $58.740 key level.

The Stochastic Oscillator has reached the oversold area, suggesting that buyers are already putting up a defense, hoping to reverse the market’s direction. The Parabolic SAR (Stop and Reverse) is currently pointing lower, indicating a bearish bias in the market.

Despite the bearish signals, buyers are not idle as they attempt to regain control and potentially reverse the downward trend. However, sell traders are still lingering, aiming to push the price lower.

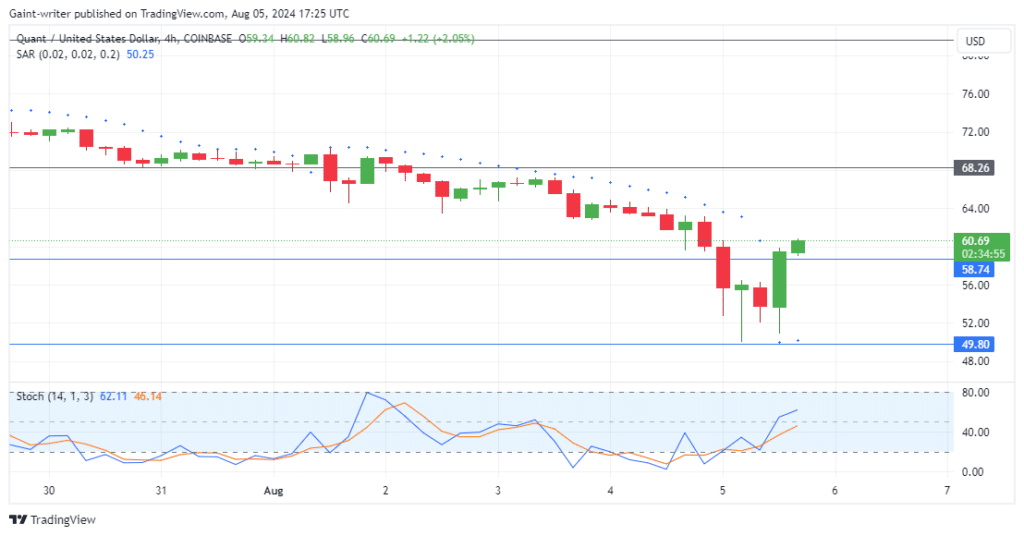

Quant Medium Term Trend: Bullish (4-hour Chart)

The Quant market in the short time frame has been a battleground, with buyers and sellers vying for control. The $0.4850 support level is a critical level to watch. A breakdown below this level could intensify selling pressure and lead to further declines.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.