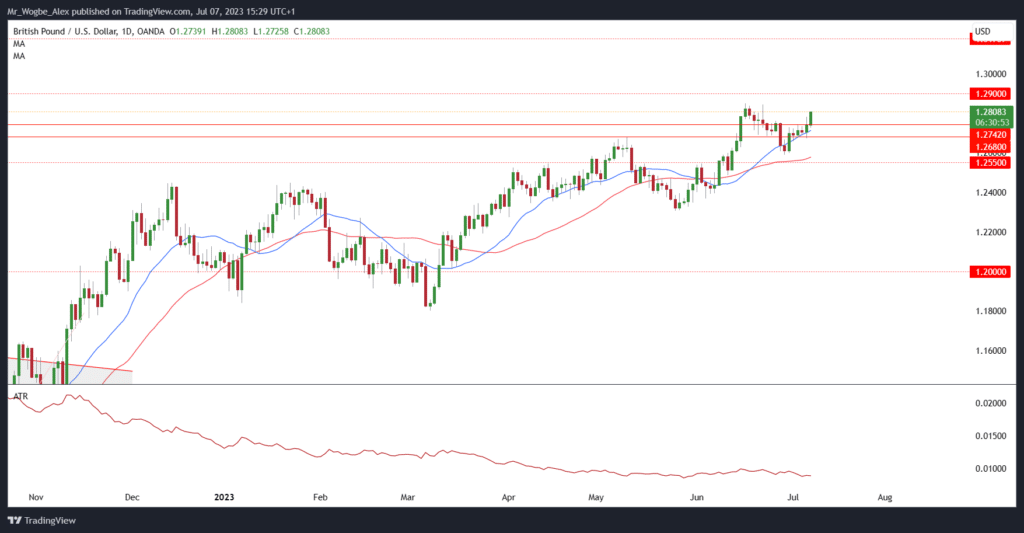

The British pound surged closer to a two-week high against the US dollar on Friday, reaching its highest point since June 22. The British currency is believed to be propelled by favorable interest rate differentials that are working in the UK’s favor. With indications that Britain may outpace both the United States and Europe in terms of rate hikes this year, the pound continues to benefit from this monetary advantage.

Bank of England Takes the Lead

While the Federal Reserve pressed the pause button on its tightening cycle in June, the Bank of England took a more assertive stance by raising its bank rate by half a percentage point last month. This bold move has set the stage for further tightening measures, with market expectations currently pricing in an additional 150 basis points of rate increases by mid-2024.

The Bank of England’s proactive approach comes at a time when consumer price inflation remains persistently high, standing at 8.7% in May. This figure is unchanged from the previous month and exceeds the Bank’s initial projections, according to a Reuters report.

source: tradingeconomics.com

The stubbornly high inflation levels have ignited anticipation in the markets that the Bank of England will need to take aggressive measures to curb price growth. Although analysts predict that these inflationary pressures will ease as we progress into the latter part of 2023, the immediate focus remains on implementing policies to rein in inflation.

Pound Reaches Two-Week High

Responding to these developments, the British pound recorded a 0.5% increase against the US dollar on Friday, surging to its highest level since June 22. The pound’s strength reflects the market’s optimistic outlook regarding the effectiveness of the UK’s monetary policy in tackling inflationary forces.

As the Federal Reserve prepares to resume its rate increases in the coming months, the Bank of England’s proactive approach may solidify the pound’s position against the US dollar. Traders and investors will closely monitor any indications of inflationary trends and subsequent policy decisions made by central banks to adjust their strategies accordingly.

That said, the US non-farm payroll and unemployment data set to be released in a few hours could influence price action in the interim.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.