US gold for August delivery rose by 1.3% to record $1,724.40/oz on New York’s Comex following the Labor Department’s report that an additional 1.9 million Americans filed for unemployment for the first time last week, bringing the total number of citizens rendered jobless by the pandemic to about 43 million since March.

Spot gold, the measure for real-time bullion trades, gained more than 1% and reached a high of $1,721 in yesterday’s session.

An analyst at New York’s OANDA, Ed Moya, said that initially there were high hopes for a strong US economic recovery, however, this week’s data has derailed that expectation. He added that the NFP data set to be released today will shed more light on the damage that occurred in the labor market last month. Ed ended by saying that the labor market will recover, regardless of how slowly, but it will be helpful if the baseline unemployment rate doesn’t go above 20%.

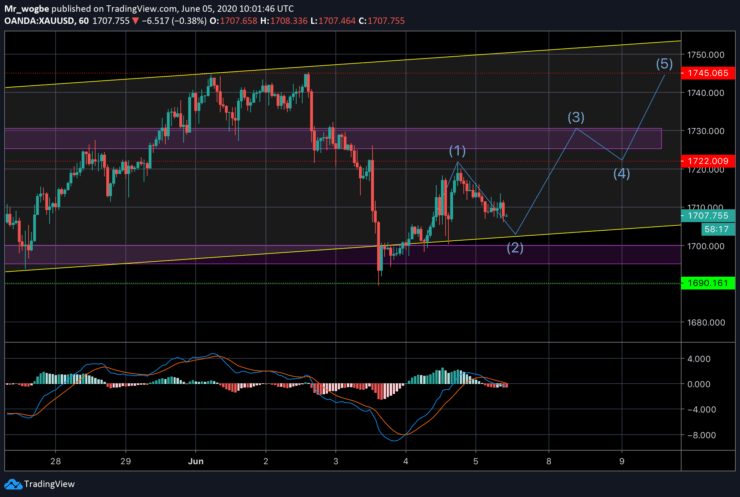

Gold (XAU) Value Forecast — June 5

XAU/USD Major Bias: Bullish

Supply Levels: $1,722, $1,730, and $1,745

Demand Levels: $1,700, $1,690, and $1,685

Gold (XAU/USD) has completed the first projected wave, hitting $1,721.48 before reversing. We are likely to see the price of gold hit the $1,702 level before we proceed on another bullish wave to $1,730. However, the NFP data release set for a few hours will be the determining factor for XAU/USD price action in the short-term.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.