Polygon wrapped up the third quarter of 2025 with impressive gains that beat the broader crypto market.

According to Messari’s latest report, POL’s circulating market cap jumped 39.2% to reach $2.36 billion, while the overall crypto market only grew by 20.7% during the same period.

The network saw real momentum in user activity. Daily transactions climbed 20.2% to hit 3.8 million, and active addresses increased by 13% to roughly 591,700.

Even more encouraging, new addresses joining the network grew 21.1% to 134,500 daily. These numbers suggest people are actually using the blockchain, not just speculating on the token.

Payments and Real-World Assets Drive Polygon Adoption

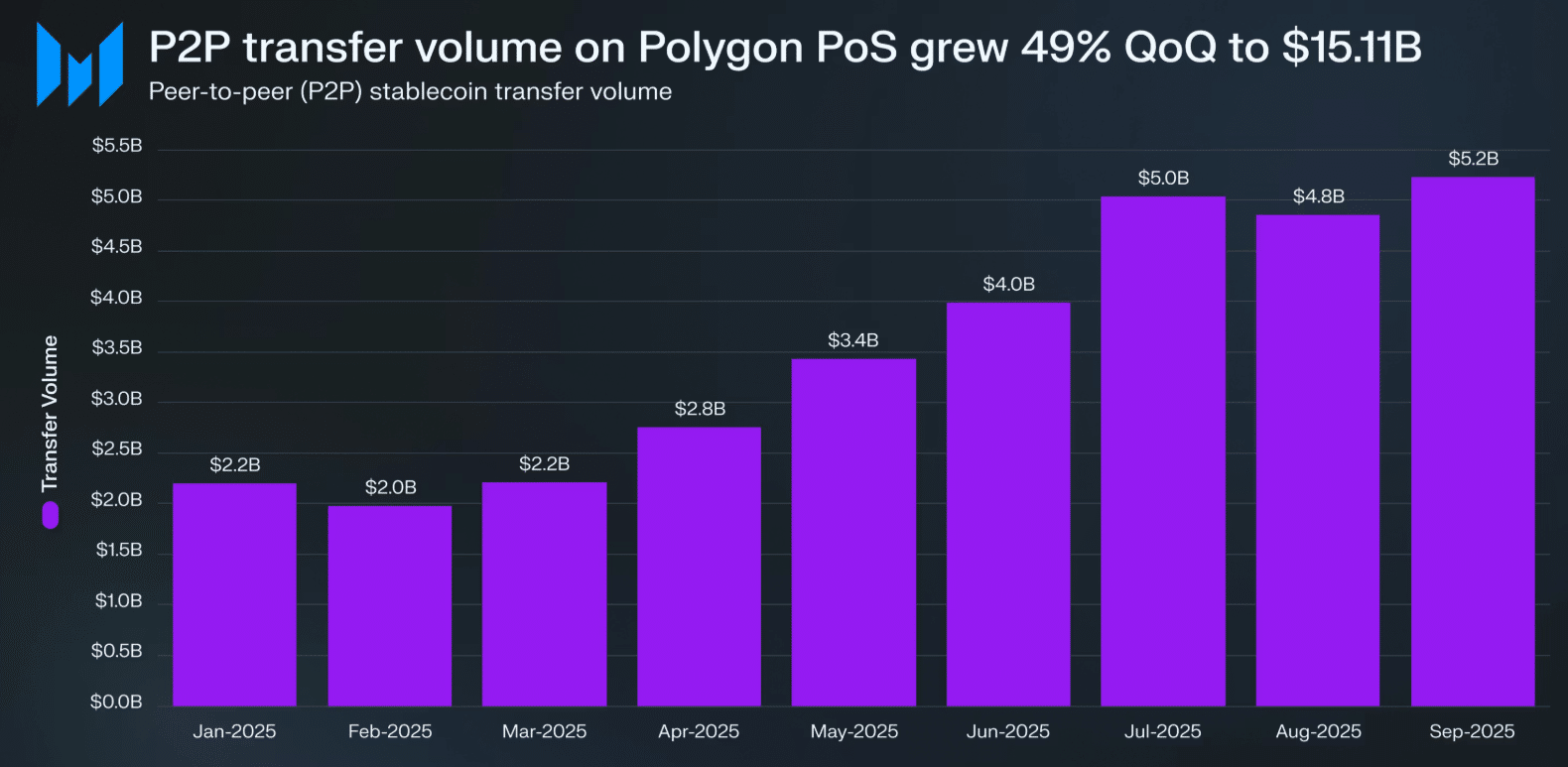

Polygon has carved out a clear niche in payments and asset tokenization. Payment apps on the network processed $1.82 billion in transfers across more than 50 platforms during Q3—a 49.2% increase from the previous quarter.

Stablecoin-linked crypto cards handled $322.2 million through Mastercard and Visa programs.

The network also made serious progress in bringing traditional assets on-chain. Real-world asset tokenization hit $1.14 billion, boosted by major institutional players.

Germany’s state-owned bank NRW.BANK issued a €100 million bond on Polygon, while Spain’s BeToken launched the country’s first regulated security token offering. Even the Philippines government got involved, using Polygon to track public funds and assets.

Stablecoin supply on the network grew 22% to $2.94 billion, with USDT leading the charge at $1.4 billion (up 35.4%). This matters because stablecoins are the fuel for payments and DeFi activity.

Infrastructure Upgrades Set Stage for Future Growth

Polygon shipped three major technical upgrades during the quarter:

- The Bhilai Hardfork: This upgrade pushed transaction capacity above 1,000 per second and added support for gasless transactions

- Heimdall v2: This slashed finality time from one or two minutes down to just five seconds

- The Rio testnet: Expected to launch on the mainnet before the end of October, this upgrade will push capacity to 5,000 transactions per second

These upgrades position Polygon to handle the kind of transaction volumes that payments and traditional finance demand.

With fees averaging just $0.0027 per transaction and falling, the network is becoming increasingly practical for everyday use cases beyond speculation.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.