Polygon is showing resilience and continued development in early 2025, according to the latest Messari research report. The blockchain network has achieved several significant milestones while maintaining growth across multiple sectors despite market fluctuations.

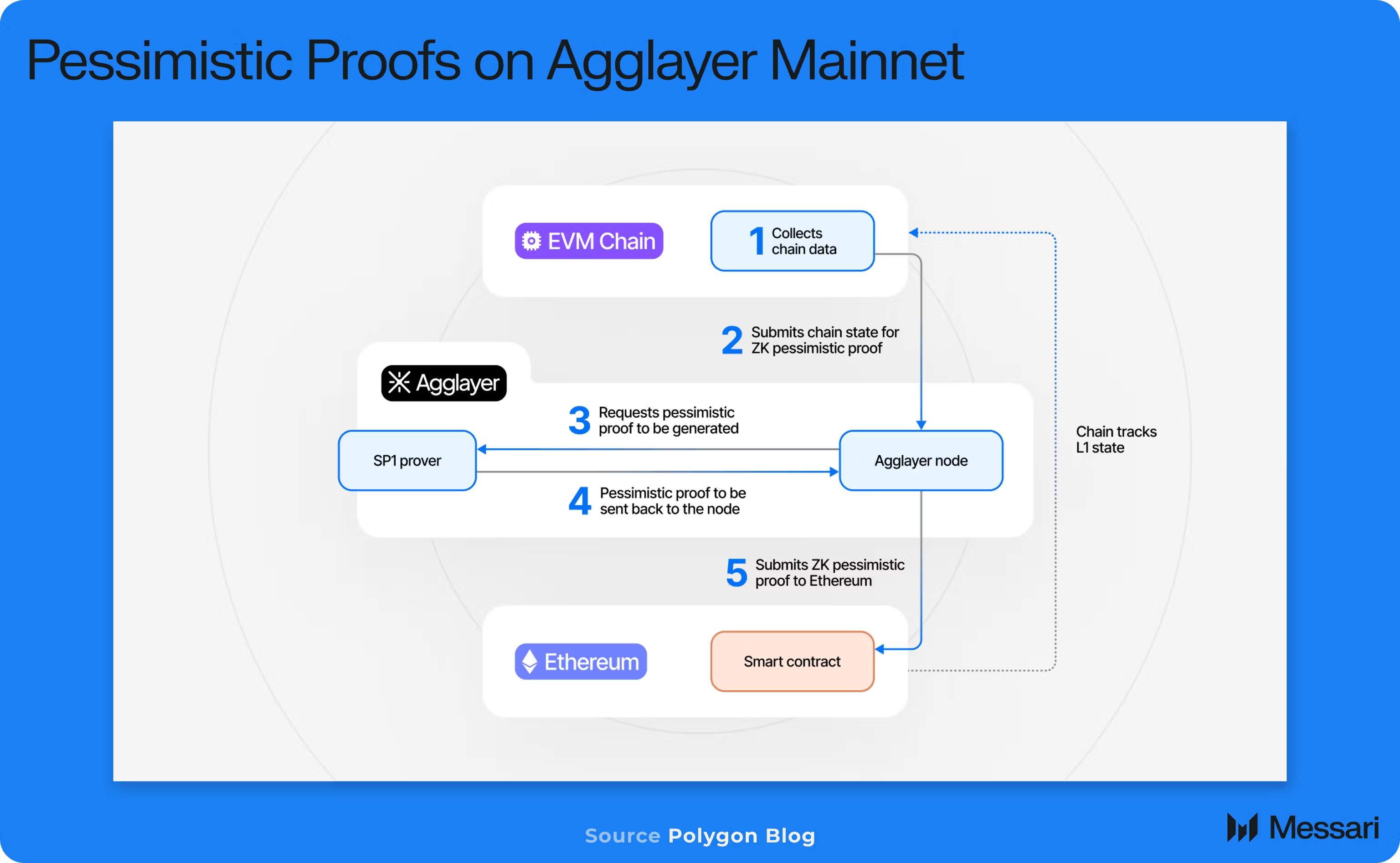

On February 3, 2025, Polygon reached a major technical breakthrough with the launch of pessimistic proofs on the Agglayer mainnet. Messari reports that this new security mechanism enables the protocol to safely unify chains with different security models, creating a more interconnected blockchain ecosystem.

The Agglayer has attracted notable integrations including Tria, SOCKET Protocol, Karate Combat, and Rome Protocol.

The pessimistic proof system works by verifying three essential conditions: that each chain updates correctly, performs accurate internal accounting, and doesn’t attempt to withdraw unbacked funds.

This creates a framework where potential misbehaving chains are isolated as threats, preventing them from endangering the broader network.

Polygon User Activity and Financial Metrics

Despite market headwinds that reduced POL’s market capitalization to $1.7 billion (a 54% quarterly decrease), Polygon’s network usage metrics showed positive growth:

Average daily active addresses on Polygon PoS increased to 546,000, representing a 4.4% growth compared to the previous quarter. Daily transactions rose to 3.4 million, an 8% increase over the same period.

That aside, the network’s stablecoin sector has emerged as particularly strong, with Polygon PoS stablecoin supply increasing by 23.3% to reach $2 billion. The stablecoin sector has become the leading category by active addresses on the network.

NFT activity has also seen substantial growth, with average daily NFT trading volume increasing to $1.4 million, a 68.2% jump from the previous quarter.

Courtyard, a major NFT marketplace on Polygon, recorded $56.5 million in sales during March alone, with Pokémon NFTs accounting for $28.9 million (51.2%) of those sales.

In the DeFi space, Polygon PoS ended Q1 with $744.8 million in total value locked. While this represents a 14.5% quarterly decrease, some protocols like Spiko and QuickSwap increased their TVL by 28.9% and 72.5%, respectively.

The network continues to be a preferred platform for payments and real-world asset tokenization. Stablecoin-linked crypto cards processed $140.7 million in combined Mastercard and Visa volume on Polygon PoS during Q1 2025. Payment applications facilitated $245.3 million in transfer volume across more than 15 platforms, up 5.8% from the previous quarter.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.