The Swiss franc emerges as a top-performing currency against the US dollar in 2023, and investors are loving it. While other currencies have struggled to make headway against the dollar, the franc has managed to hold its own and even make gains in the current economic climate. This trend is likely to continue as US economic data continues to disappoint, with this week’s NFP print and next week’s CPI data being closely watched.

The recent banking troubles in the US have added to the safe-haven appeal of the franc, with investors flocking to the currency for protection against market volatility. JP Morgan’s absorption of First Republic Bank has led to two potentially troubled lenders emerging in the banking sector, PacWest Bancorp and Western Alliance, resulting in massive declines in their respective share prices. As a result, the franc has become an attractive option for investors looking for a safe haven.

Outlook for Swiss Franc Remains Bullish

The Swiss National Bank’s Chairman, Thomas Jordan, has maintained a hawkish stance towards inflation and interest rates, which has further bolstered the franc’s outlook. He believes that inflation is too high, and interest rates could still rise, leading to a market-implied rate expectation of another 44 basis points worth of hikes. This has led many to believe that the terminal rate could emerge at 2%, further strengthening the franc’s bullish outlook.

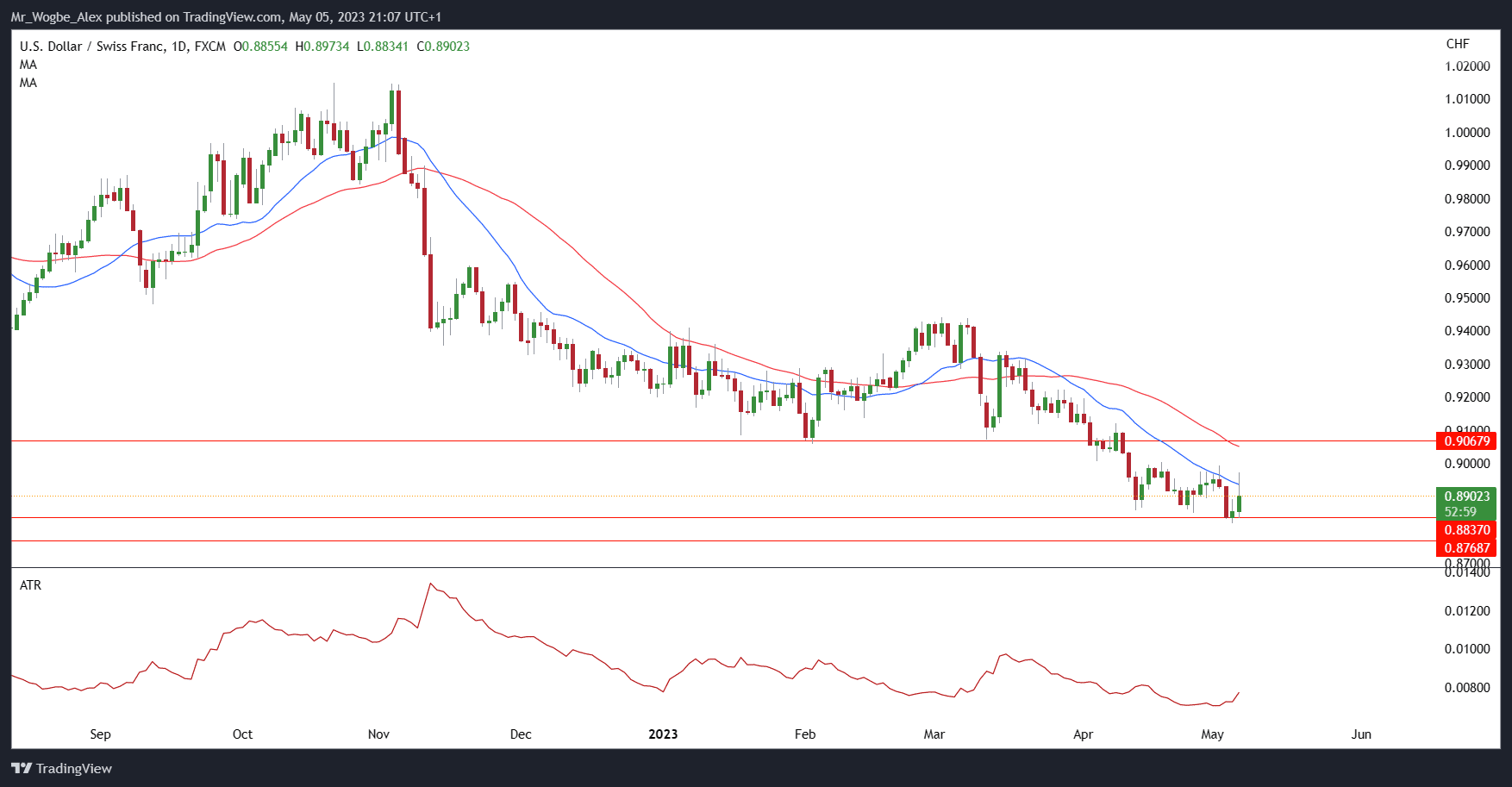

Looking at the USD/CHF chart, it is clear that the bearish trend has been dominating the market, with lower lows and lower highs being the order of the day. While the dollar has experienced a temporary pullback, it finds resistance at the 0.9067 mark, which has acted as dynamic support throughout the rapid decline. Support levels are expected at around 0.8830, followed by swing lows of 0.8820 and 0.8768.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.